Business

Top 7 Reasons to Invest in Real Estate Right Now

In the world of real estates, the risk of loss can be greatly reduced by the length of the time you hold the property. Top Reasons to Invest in Real Estate.

In this day and age, investment options have become abundant to the point of confusion. And whilst this variety of options may suit experienced investors who want to expand and diversify their portfolios, newcomers may have a problem sorting out through all these courses of action.

Enter the real estate market, which has always served as a perfect playing ground for all the people who have the money but don’t like too much risk. But, what makes real estate such a safe investment option, and why should you enter this arena right now?.

Let us try to find out. commercial bridge loans

Table of Contents

1. Less volatility than the stock market

In the world of real estate, the risk of loss can be greatly reduced by the length of the time you hold the property. If we look at the industry’s history, we can see that the market has proved to be incredibly resistant to sudden price fluctuations.

If you are not flipping the properties or making frequent transactions, the very fact you are holding on to property can help you tame these volatile changes and continue generating wealth through income capital.

2. A stable passive income flow

If you find reliable and high-paying tenants and reach the agreement over the long-term lease, this period of stable, uninterrupted income returns can stretch for entire years. While you are making those earnings, your duties are kept at a bare minimum.

You will need to take good care of the maintenance, be quick to respond to tenants’ requests, and make a long-term upgrade plan that will keep your investment competitive in years to come.

Still, the ample earnings that usually cover the mortgage price make these minor efforts more than worthwhile.

3. The banks love properties

Historically speaking, the banks were always more than willing to back up investors venturing into the real estate market.

So much so that some countries like Australia were forced to step in and ask the banks to curb the enthusiasm of property investors by introducing higher interest rates.

Even so, appealing to banks still makes the most streamlined way of ensuring the investment funds, and the inherent market stability makes sure these appeals won’t fall on deaf ears.

4. The value of properties increases as time goes by

One of the best things about properties as an investment option is that they possess tangible value. And unlike some other assets, their value doesn’t decrease over time. On the contrary – smart investments will produce substantial growth.

If we, once again, take a look at the Land Down Under, we can see that the real estate in Northern Beaches (Sydney’s coastline suburban area) is projected to undergo a significant value increase in the following years due to favourable and opportune location.

5. Portfolio diversification

As even the most inexperienced investors know, diversification produces a more stable portfolio.

Considering real estate’s inherent stability introducing this income flow into your set of options can increase the value and balance out even the most volatile investment strategies through fluctuating economic cycles.

As long as you know the relative difficulty of converting these assets into money, your portfolio can only benefit from this type of diversification.

6. The ability to leverage tax-breaks

Considering that properties are hard assets that play a large role in governmental well-being, local governments are usually ready to offer to property owners various monetary reliefs, which is a rare case with the other investment options.

In most cases, these reliefs come in tax breaks and writing off of interest rates, property management fees, and maintenance fees.

These benefits can go a long way in making the average investments much more valuable.

7. You are negotiating the price

The one thing that connects all the currently available share markets is buying and selling assets according to their market price, without much say.

The real estate market is completely different – the value of the rents and the very property is more than open to negotiations.

And talking into consideration that the real estate demand far outweighs the offer, you have a very strong bargain position you can leverage during such negotiations.

We hope these seven considerations showed you just how prudent investing in the real estate market could actually be.

No matter whether you are a newcomer who wants to avoid high-risk investments or you are simply looking for a way to anchor your existing portfolio, hard assets like properties always make the most sensible solution.

Business

Navigating the Process of Selling Deceased Estate Shares

This article aims to provide a comprehensive guide to selling shares from a deceased estate. Process of Selling Deceased Estate Shares.

Table of Contents

1. Understanding the Basics of Selling Deceased Estate Shares

Dealing with a deceased estate can be a challenging and emotional process, especially when it comes to handling financial assets like shares. This article aims to provide a comprehensive guide to selling shares from a deceased estate.

2. What are Deceased Estate Shares?

Deceased estate shares refer to the stocks and shares that were owned by an individual who has passed away. These shares become part of the deceased’s estate and are subject to the terms of their will or estate plan.

3. The Importance of Valuing the Shares

The first step in selling deceased estate shares is to obtain a current valuation. This valuation is crucial for several reasons: it helps in distributing the estate among beneficiaries, it may be necessary for tax purposes, and it gives an idea of the market value of the shares.

4. Legal Requirements and Executor Responsibilities

The executor of the estate plays a pivotal role in the management and distribution of the deceased’s assets. This section will cover the legal responsibilities and steps the executor needs to take to lawfully sell the shares.

5. Obtaining Probate

Before any action can be taken with the shares, it’s often necessary to obtain probate. Probate is a legal process that confirms the executor’s authority to deal with the deceased’s assets.

Transferring Shares into the Executor’s Name

Once probate is granted, shares may need to be transferred into the name of the executor. This process varies depending on the company and the type of shares.

6. The Process of Selling Shares

After completing legal formalities, the executor can proceed with selling the shares. This section will outline the steps involved in this process, including choosing a brokerage or financial service, understanding market conditions, and making informed decisions.

Deciding on the Right Time to Sell

Timing can significantly impact the returns from selling shares. Executors need to consider market conditions and financial advice to determine the best time to sell.

Completing the Sale

This subsection will detail the actual process of selling shares, including placing orders, handling transaction fees, and ensuring all regulatory requirements are met.

7. Navigating Tax Implications and Reporting

Managing tax obligations is a critical aspect of selling deceased estate shares. This section will explain the potential tax implications and the importance of accurate reporting for both capital gains tax and inheritance tax considerations.

Understanding Capital Gains Tax Responsibilities

When shares are sold, any profit made from the time of the deceased’s passing to the sale date may be subject to capital gains tax. Executors need to be aware of these implications and plan accordingly.

Inheritance Tax Considerations

In some jurisdictions, the value of the deceased estate’s shares might impact inheritance tax calculations. It’s essential for executors to understand these aspects in order to ensure compliance with tax laws.

8. Common Challenges and How to Overcome Them

Selling deceased estate shares can present unique challenges. This section will discuss common issues such as disputed wills, fragmented information about the shares, and market volatility.

Dealing with Disputed Wills and Beneficiary Disagreements

Disputes over the will or disagreements among beneficiaries can complicate the process. Executors must handle these situations delicately and legally.

Managing Market Volatility

Shares can be subject to market fluctuations. Executors should be prepared for this volatility and may need to consult financial advisors to navigate these waters effectively.

9. Tips for Executors Handling Deceased Estate Shares

This section will provide practical advice for executors, including the importance of seeking professional advice, keeping thorough records, and communicating clearly with beneficiaries.

Seeking Professional Financial and Legal Advice

The complexity of selling shares from a deceased estate often necessitates professional advice. This can range from legal counsel to financial advisory services.

Record Keeping and Communication with Beneficiaries

Maintaining transparent and thorough records is crucial. Executors should also prioritize clear and consistent communication with all beneficiaries to avoid misunderstandings.

Conclusion

Selling shares from a deceased estate is a responsibility that requires careful attention to legal, financial, and interpersonal dynamics. By understanding the process, staying informed about tax obligations, and tackling challenges head-on, executors can fulfill their duties effectively and respectfully.

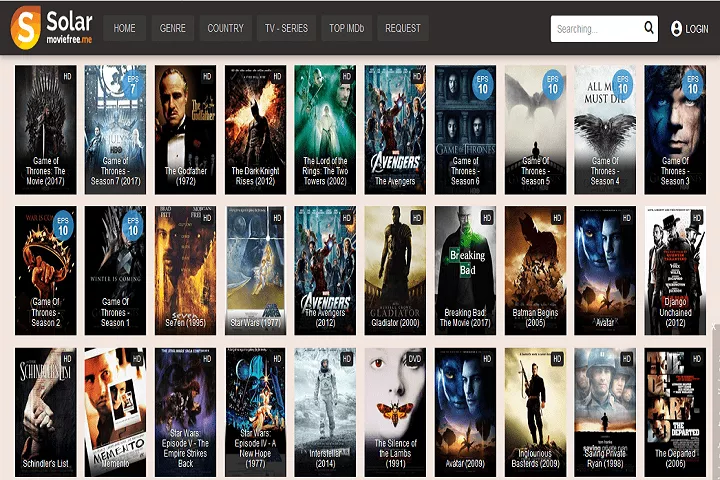

Instagram3 years ago

Instagram3 years agoBuy IG likes and buy organic Instagram followers: where to buy them and how?

Instagram3 years ago

Instagram3 years ago100% Genuine Instagram Followers & Likes with Guaranteed Tool

Business4 years ago

Business4 years ago7 Must Have Digital Marketing Tools For Your Small Businesses

Instagram3 years ago

Instagram3 years agoInstagram Followers And Likes – Online Social Media Platform