Business

Transforming Goals into Actionable Results

Organizations universally set goals and strategic plans each year, aiming to grow revenue, increase efficiency, or launch innovative offerings. Leadership teams devote extensive energy to developing future visions, five-year horizons, and stretched objectives to motivate their workforce.

But the hard truth remains: lofty ambitions alone rarely catalyze actual change. For transformational plans to spark tangible impacts, organizations must bridge the gap between theoretical strategy and on-the-ground execution.

Table of Contents

1. The Planning Disconnect

Many goal-setting approaches prioritize inspiration over implementation. Leadership defines desires for the future: – become a $1 billion revenue company, penetrate emerging markets, and transform customer experiences through AI. Such ‘aim-big’ mindsets spark energy and provide directional guidance amid uncertainty.

However, most planning exercises fail to detail the nitty-gritty work required to achieve audacious results on the ground. People walk out of annual meetings jazzed about the future but without playbooks for activating it day-to-day. Vague aspirations then struggle to be converted into economic value.

2. Finding the Right Strategy

An OKR planning template offers one methodology to overcome this strategy/execution divide. OKRs, or Objectives and Key Results, provide a template to cascade high-level goals into measurable, actionable metrics at every organizational level. This connects future milestones with present-moment decision-making, ensuring teams work synergistically towards overarching ambitions. With a strong goal architecture in place, inspiration more seamlessly fuels activation.

3. Why Actionability Matters

Transforming lofty aspirations into step-by-step execution plans brings several advantages:

- Alignment: With clear OKRs spanning functions, teams can coordinate priorities, resources, and timelines effectively. This fosters organization-wide momentum versus siloed efforts.

- Motivation:Breaking ambitious objectives into bite-sized key results is less daunting for individuals. Granular metrics maintain motivation amid long horizons.

- Focus: Concrete next steps prevent distraction from organizational shiny objects that capture attention yet deliver little value.

- Accountability: Quantifiable measures allow all stakeholders, from frontline individuals to CEOs, to track progress and course-correct in real-time if lagging.

With a strong goal architecture in place, inspiration more seamlessly fuels activation. But we still must apply rigorous execution principles—communication, tracking, agility, and celebration—to generate the hoped-for results.

4. Driving Change in Complex Systems

Large enterprises are multifaceted systems, with interdependent elements spanning processes, technology, and people. This complexity makes driving macro-level outcomes uniquely challenging. As legendary management thinker Peter Drucker noted, “There is nothing so useless as doing efficiently that which should not be done at all.”

Turning broad organizational change into economic returns requires carefully targeting the vital few interventions that catalyze outsized results. OKRs help leaders thoughtfully assess and sequence the projects that will structurally reinvent operations, remove friction from value chains, and upgrade talent capabilities over time. With clear transformations roadmaps in place, big goals become more grounded amid real-world constraints.

5. Sustaining the Journey

Finally, cascading OKRs across the hierarchy sustains strategic focus as leaders come and go. They provide continuity through inevitable ebbs and flows in the volatile, uncertain business climate. With institutionalized processes for regularly resetting, communicating, and reviewing objectives and key results, organizations stay centered on the handful of big bets that matter most while retaining the flexibility to evolve tactics as needed.

Annual goal setting is table stakes for contemporary organizations. But without concerted efforts to turn those goals into measurable action plans, little changes amid organizational complexity.

Business

Navigating the Process of Selling Deceased Estate Shares

This article aims to provide a comprehensive guide to selling shares from a deceased estate. Process of Selling Deceased Estate Shares.

Table of Contents

1. Understanding the Basics of Selling Deceased Estate Shares

Dealing with a deceased estate can be a challenging and emotional process, especially when it comes to handling financial assets like shares. This article aims to provide a comprehensive guide to selling shares from a deceased estate.

2. What are Deceased Estate Shares?

Deceased estate shares refer to the stocks and shares that were owned by an individual who has passed away. These shares become part of the deceased’s estate and are subject to the terms of their will or estate plan.

3. The Importance of Valuing the Shares

The first step in selling deceased estate shares is to obtain a current valuation. This valuation is crucial for several reasons: it helps in distributing the estate among beneficiaries, it may be necessary for tax purposes, and it gives an idea of the market value of the shares.

4. Legal Requirements and Executor Responsibilities

The executor of the estate plays a pivotal role in the management and distribution of the deceased’s assets. This section will cover the legal responsibilities and steps the executor needs to take to lawfully sell the shares.

5. Obtaining Probate

Before any action can be taken with the shares, it’s often necessary to obtain probate. Probate is a legal process that confirms the executor’s authority to deal with the deceased’s assets.

Transferring Shares into the Executor’s Name

Once probate is granted, shares may need to be transferred into the name of the executor. This process varies depending on the company and the type of shares.

6. The Process of Selling Shares

After completing legal formalities, the executor can proceed with selling the shares. This section will outline the steps involved in this process, including choosing a brokerage or financial service, understanding market conditions, and making informed decisions.

Deciding on the Right Time to Sell

Timing can significantly impact the returns from selling shares. Executors need to consider market conditions and financial advice to determine the best time to sell.

Completing the Sale

This subsection will detail the actual process of selling shares, including placing orders, handling transaction fees, and ensuring all regulatory requirements are met.

7. Navigating Tax Implications and Reporting

Managing tax obligations is a critical aspect of selling deceased estate shares. This section will explain the potential tax implications and the importance of accurate reporting for both capital gains tax and inheritance tax considerations.

Understanding Capital Gains Tax Responsibilities

When shares are sold, any profit made from the time of the deceased’s passing to the sale date may be subject to capital gains tax. Executors need to be aware of these implications and plan accordingly.

Inheritance Tax Considerations

In some jurisdictions, the value of the deceased estate’s shares might impact inheritance tax calculations. It’s essential for executors to understand these aspects in order to ensure compliance with tax laws.

8. Common Challenges and How to Overcome Them

Selling deceased estate shares can present unique challenges. This section will discuss common issues such as disputed wills, fragmented information about the shares, and market volatility.

Dealing with Disputed Wills and Beneficiary Disagreements

Disputes over the will or disagreements among beneficiaries can complicate the process. Executors must handle these situations delicately and legally.

Managing Market Volatility

Shares can be subject to market fluctuations. Executors should be prepared for this volatility and may need to consult financial advisors to navigate these waters effectively.

9. Tips for Executors Handling Deceased Estate Shares

This section will provide practical advice for executors, including the importance of seeking professional advice, keeping thorough records, and communicating clearly with beneficiaries.

Seeking Professional Financial and Legal Advice

The complexity of selling shares from a deceased estate often necessitates professional advice. This can range from legal counsel to financial advisory services.

Record Keeping and Communication with Beneficiaries

Maintaining transparent and thorough records is crucial. Executors should also prioritize clear and consistent communication with all beneficiaries to avoid misunderstandings.

Conclusion

Selling shares from a deceased estate is a responsibility that requires careful attention to legal, financial, and interpersonal dynamics. By understanding the process, staying informed about tax obligations, and tackling challenges head-on, executors can fulfill their duties effectively and respectfully.

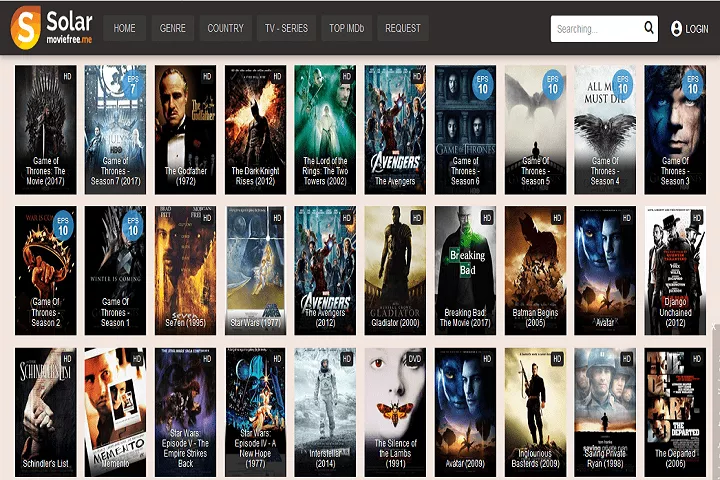

Instagram3 years ago

Instagram3 years agoBuy IG likes and buy organic Instagram followers: where to buy them and how?

Instagram3 years ago

Instagram3 years ago100% Genuine Instagram Followers & Likes with Guaranteed Tool

Business5 years ago

Business5 years ago7 Must Have Digital Marketing Tools For Your Small Businesses

Instagram4 years ago

Instagram4 years agoInstagram Followers And Likes – Online Social Media Platform