Business

How to Pay The Mortgage When You’re Between Jobs

How to pay the mortgage when you’re between jobs. Dealing with your mortgage is probably the last thing you want to do when you’re between jobs.

Being between jobs isn’t easy. Chances are you’re finding it difficult to cover the expenses you usually don’t have trouble covering, including your mortgage.

It’s easy to feel overwhelmed and go into panic mode as soon as you realize you don’t have enough to pay your mortgage.

Luckily, there’s no need to do so as there are ways to pay your mortgage even when you’re between jobs. With that in mind, let’s take a closer look at the five options at your disposal.

Table of Contents

1. Contact your lender

Why wait until you start getting all those calls from your lender once they realize you’re late with the mortgage? It’s a much better idea to give them a call yourself and show responsibility and determination to pay it even though you’re between jobs.

Explain your situation to the lender and they might be able to offer you a deal that fixes it all. For example, they might be able to lower your mortgage, allowing you to pay it and still be left with some money even though you don’t receive a paycheck at the moment.

They might also decide to change the due date for your mortgage and give you enough time to get a new gig.

2. Make some extra money

If you don’t have a job, it doesn’t mean there’s no way you can make money. The web has made it possible for anyone to make some extra money and all it takes is a little bit of time and effort.

The best thing about it is that you can choose an online job that suits your skills and needs. For example, if you speak a foreign language, you can teach it online as long as you have a good camera and internet connection.

Some other online jobs include taking paid surveys and working as a freelance writer. Calculate how much money you can make and it might just be enough to help you pay the mortgage until you find a new job.

3. Apply for a payday loan

Being between jobs can be quite tricky and if you don’t find a way to make some extra cash, you’ll struggle to both pay your mortgage and cover your everyday expenses.

Luckily, there are special loans designed specifically for people who are in such a situation and could use some extra money as quickly as possible.

Companies that give payday loans can provide you with money instantly and let you repay the loan once your financial situation improves. There are numerous repayments available, meaning that you can choose the option that suits your situation the best.

4. Reduce your spending

Not always will you be able to get a better deal from the lender and exploring some other options is a must. Since you won’t be receiving a paycheck until you find a new job, you might want to reduce your spending until then.

The best way to do it is to calculate your living expenses and figure out how much you’re supposed to set aside to have enough to pay your mortgage.

Luckily, there are so many ways to save money and you just have to find the ones that work for you. For example, you could give up smoking or stop using your credit card and switch to cash instead.

5. Consider declaring bankruptcy

This isn’t necessarily the most favorable option but if you’re out of ideas, declaring bankruptcy might be a good way to get your financial situation back on track without having to worry about the mortgage.

It’s an option worth considering if you believe you’ll struggle to get hired. If you declare bankruptcy, you’ll be protected from creditors repossessing the house or anything else you might own.

This should give you enough time to get a new job and cover some other expenses before starting to pay your mortgage once again. The downside is that you can expect your credit to be seriously hurt for quite a long period afterward.

Dealing with your mortgage is probably the last thing you want to do when you’re between jobs. Still, it’s something you simply have to do, and finding the best way to do it should help you pay your mortgage and retain control over your budget before getting a new job.

Business

Navigating the Process of Selling Deceased Estate Shares

This article aims to provide a comprehensive guide to selling shares from a deceased estate. Process of Selling Deceased Estate Shares.

Table of Contents

1. Understanding the Basics of Selling Deceased Estate Shares

Dealing with a deceased estate can be a challenging and emotional process, especially when it comes to handling financial assets like shares. This article aims to provide a comprehensive guide to selling shares from a deceased estate.

2. What are Deceased Estate Shares?

Deceased estate shares refer to the stocks and shares that were owned by an individual who has passed away. These shares become part of the deceased’s estate and are subject to the terms of their will or estate plan.

3. The Importance of Valuing the Shares

The first step in selling deceased estate shares is to obtain a current valuation. This valuation is crucial for several reasons: it helps in distributing the estate among beneficiaries, it may be necessary for tax purposes, and it gives an idea of the market value of the shares.

4. Legal Requirements and Executor Responsibilities

The executor of the estate plays a pivotal role in the management and distribution of the deceased’s assets. This section will cover the legal responsibilities and steps the executor needs to take to lawfully sell the shares.

5. Obtaining Probate

Before any action can be taken with the shares, it’s often necessary to obtain probate. Probate is a legal process that confirms the executor’s authority to deal with the deceased’s assets.

Transferring Shares into the Executor’s Name

Once probate is granted, shares may need to be transferred into the name of the executor. This process varies depending on the company and the type of shares.

6. The Process of Selling Shares

After completing legal formalities, the executor can proceed with selling the shares. This section will outline the steps involved in this process, including choosing a brokerage or financial service, understanding market conditions, and making informed decisions.

Deciding on the Right Time to Sell

Timing can significantly impact the returns from selling shares. Executors need to consider market conditions and financial advice to determine the best time to sell.

Completing the Sale

This subsection will detail the actual process of selling shares, including placing orders, handling transaction fees, and ensuring all regulatory requirements are met.

7. Navigating Tax Implications and Reporting

Managing tax obligations is a critical aspect of selling deceased estate shares. This section will explain the potential tax implications and the importance of accurate reporting for both capital gains tax and inheritance tax considerations.

Understanding Capital Gains Tax Responsibilities

When shares are sold, any profit made from the time of the deceased’s passing to the sale date may be subject to capital gains tax. Executors need to be aware of these implications and plan accordingly.

Inheritance Tax Considerations

In some jurisdictions, the value of the deceased estate’s shares might impact inheritance tax calculations. It’s essential for executors to understand these aspects in order to ensure compliance with tax laws.

8. Common Challenges and How to Overcome Them

Selling deceased estate shares can present unique challenges. This section will discuss common issues such as disputed wills, fragmented information about the shares, and market volatility.

Dealing with Disputed Wills and Beneficiary Disagreements

Disputes over the will or disagreements among beneficiaries can complicate the process. Executors must handle these situations delicately and legally.

Managing Market Volatility

Shares can be subject to market fluctuations. Executors should be prepared for this volatility and may need to consult financial advisors to navigate these waters effectively.

9. Tips for Executors Handling Deceased Estate Shares

This section will provide practical advice for executors, including the importance of seeking professional advice, keeping thorough records, and communicating clearly with beneficiaries.

Seeking Professional Financial and Legal Advice

The complexity of selling shares from a deceased estate often necessitates professional advice. This can range from legal counsel to financial advisory services.

Record Keeping and Communication with Beneficiaries

Maintaining transparent and thorough records is crucial. Executors should also prioritize clear and consistent communication with all beneficiaries to avoid misunderstandings.

Conclusion

Selling shares from a deceased estate is a responsibility that requires careful attention to legal, financial, and interpersonal dynamics. By understanding the process, staying informed about tax obligations, and tackling challenges head-on, executors can fulfill their duties effectively and respectfully.

Instagram3 years ago

Instagram3 years agoBuy IG likes and buy organic Instagram followers: where to buy them and how?

Instagram3 years ago

Instagram3 years ago100% Genuine Instagram Followers & Likes with Guaranteed Tool

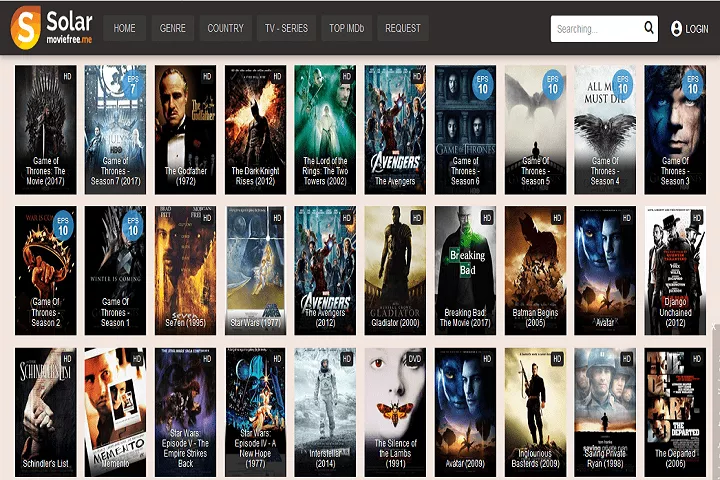

Business5 years ago

Business5 years ago7 Must Have Digital Marketing Tools For Your Small Businesses

Instagram4 years ago

Instagram4 years agoInstagram Followers And Likes – Online Social Media Platform