Business

An Explanation Of The Different Kinds Of Mortgages

We have summarized some of the more common kinds of mortgages that are available to homeowners below so that you can be confident when approaching the home buying process.

So you have found your dream house and are ready to make an offer. Congratulations! All that is left to do now is get a home loan secured from a lender to pay for the house. If you are a first-time homebuyer it can, of course, be confusing to navigate all of the ins and outs of getting a mortgage and it is not an easy process.

Before making a final decision on a home loan, be sure to research all of the mortgage options that are available to you very thoroughly. The home’s location, how long you are planning to live in the house, and competition from other buyers for the home are all factors to consider when shopping for a home loan. You will ideally also want a mortgage that does not break your budget with high-interest rates and exorbitant fees.

We have summarized some of the more common kinds of mortgages that are available to homeowners below so that you can be confident when approaching the home-buying process.

Table of Contents

1. The Basics

Homeowners need to be aware that a majority of mortgages are either classified as conventional home loans or government-insured loans. The federal government insures government-insured loans, but not conventional home loans – which makes them a bit riskier for lenders. That means that home buyers who are looking to take out a conventional home loan are going to likely need to have excellent credit.

The size of a home loan is another way to characterize them. Most of them are either jumbo loans or conforming loans. Along with the size and insurance source of a loan, the structure of the interest rate is another key characteristic of home loans.

Typically, mortgages are either classified as fixed-rate mortgages, which means that the interest rate does not change, or as adjustable-rate mortgages, which means the interest rate adjusts and changes over time based on the current market conditions.

2. Conventional Mortgage

One of the more common kinds of mortgages that are available to homeowners is the conventional home loan. The federal government does not insure this type of loan. Non-conforming home loans are conventional mortgages that exceed federal loan limits. A jumbo home loan is the most common kind of non-conforming home loan. Bankrate.com says that jumbo home loans are used whenever the price of the home exceeds the federal loan limit.

Since the government does not back conventional loans there isn’t any guarantee that the borrower will pay back the loan, which for the lender, makes them a riskier type of loan to offer. That is why typically conventional home loan borrowers must have limited debt, a good credit history, and a high income. It can be hard to qualify for conventional mortgages, but for those homeowners who are able to, there are some advantages. If a 20 percent down payment or more is made on a conventional mortgage, private mortgage insurance (PMI) will not need to be paid.

3. Government-Insured Mortgage

Government-backed loans are a popular alternative to conventional mortgages. Three government agencies insure these loans, including the US Department of Agriculture (USDA), the US Department of Veteran Affairs (VA), and the Federal Housing Administration (FHA). The following is a quick overview of these three government-insured types of mortgages.

FHA Loans – An FHA mortgage is often considered to be the easiest type of loan for homeowners to get. The reason for this is that lenders will be more likely to take on the risk of borrowers who are less than perfect since the loan will be covered by the FHA if the borrower falls behind on their payments. A large down payment is not required by the Texas FHA loan.

Those with an FHA loan, in fact, can put down as low as 3.5 percent of the total purchase price to purchase a home. To qualify for an FHA loan, homeowners also don’t need to have a high credit score. However, FHA loans do have a few downsides associated with them that homebuyers need to consider.

First of all, an FHA loan can only be used to buy a primary residence – not an investment property or secondary residence. Second, high mortgage insurance premiums must be paid by homebuyers, which can increase the cost of their mortgages.

VA Loans – Another good alternative to conventional mortgages is the VA loan. However, in order to qualify for this type of loan, homeowners must either be active members or veterans of the United States military. Service members who do qualify are able to get a mortgage without being required to pay mortgage insurance or make a down payment.

Bankrate.com reports that closing costs frequently are paid by the seller and are capped. Although VA loans are a very affordable alternative to conventional mortgages, there are also a few downsides associated with them. To begin with, there are a limited number of buyers who are able to qualify for this kind of home loan.

Second, there are also restrictions on the kinds of properties that you can buy with a VA loan. For example, this type of loan cannot be used to buy rental properties. Third, homebuyers who buy a house using a VA loan are charged a funding fee, that can range from 1.25 percent up to 3.3 percent of the total amount that is borrowed.

USDA loans – This type of loan is for low-income homebuyers who want to buy a property that is located in specific designated rural areas. Before applying for a USDA loan, a homebuyer will need to check to see whether the address qualifies as one of the rural areas. USDA loans have low-interest rates and do not require high credit scores or a down payment.

However, the drawback is that borrowers need to be low or moderate-income earners. The benefits of this type of loan also vary depending on the amount of money the borrower earns. Homebuyers also can only qualify for this type of loan when the house that they want to buy is in a designated rural area according to the USDA.

4. Fixed-Rate Mortgage

For those homebuyers who prefer predictability and stability, the best option is probably a fixed-rate mortgage. Those who opt for a fixed-rate home loan will be paying the same mortgage payment each month over the entire life of their loan, no matter what the current interest rates are or how much they increase or decrease.

Typically, a fixed-rate loan has a lifetime of 30, 20, or 15 years. For homeowners with a fixed-rate mortgage, knowing that their mortgage payments each month will always be the same allows them to be able to budget their expenses based on this.

However, it can also make it a slow process to build equity in their homes. Typically, interest rates are also higher on fixed-rate mortgages. That is why a fixed-rate mortgage might not be the best fit for borrowers who are not planning on staying in their houses for a very long time.

5. Adjustable-Rate Mortgage

An adjustable-rate mortgage, or ARM, offers loans with non-fixed interest rates. The rate instead changes and fluctuates based on the current market conditions. That means that homeowners who have an ARM loan might have lower monthly mortgage payments over a certain time period.

However, after a certain period of time, those monthly payments are subject to change, which makes them unpredictable for homeowners who are planning to stay in their houses over a long time period. For example, homeowners who have a 5/1 ARM might have a great interest rate for five years but then their monthly rate might increase each subsequent year based on the current market conditions.

Business

Navigating the Process of Selling Deceased Estate Shares

This article aims to provide a comprehensive guide to selling shares from a deceased estate. Process of Selling Deceased Estate Shares.

Table of Contents

1. Understanding the Basics of Selling Deceased Estate Shares

Dealing with a deceased estate can be a challenging and emotional process, especially when it comes to handling financial assets like shares. This article aims to provide a comprehensive guide to selling shares from a deceased estate.

2. What are Deceased Estate Shares?

Deceased estate shares refer to the stocks and shares that were owned by an individual who has passed away. These shares become part of the deceased’s estate and are subject to the terms of their will or estate plan.

3. The Importance of Valuing the Shares

The first step in selling deceased estate shares is to obtain a current valuation. This valuation is crucial for several reasons: it helps in distributing the estate among beneficiaries, it may be necessary for tax purposes, and it gives an idea of the market value of the shares.

4. Legal Requirements and Executor Responsibilities

The executor of the estate plays a pivotal role in the management and distribution of the deceased’s assets. This section will cover the legal responsibilities and steps the executor needs to take to lawfully sell the shares.

5. Obtaining Probate

Before any action can be taken with the shares, it’s often necessary to obtain probate. Probate is a legal process that confirms the executor’s authority to deal with the deceased’s assets.

Transferring Shares into the Executor’s Name

Once probate is granted, shares may need to be transferred into the name of the executor. This process varies depending on the company and the type of shares.

6. The Process of Selling Shares

After completing legal formalities, the executor can proceed with selling the shares. This section will outline the steps involved in this process, including choosing a brokerage or financial service, understanding market conditions, and making informed decisions.

Deciding on the Right Time to Sell

Timing can significantly impact the returns from selling shares. Executors need to consider market conditions and financial advice to determine the best time to sell.

Completing the Sale

This subsection will detail the actual process of selling shares, including placing orders, handling transaction fees, and ensuring all regulatory requirements are met.

7. Navigating Tax Implications and Reporting

Managing tax obligations is a critical aspect of selling deceased estate shares. This section will explain the potential tax implications and the importance of accurate reporting for both capital gains tax and inheritance tax considerations.

Understanding Capital Gains Tax Responsibilities

When shares are sold, any profit made from the time of the deceased’s passing to the sale date may be subject to capital gains tax. Executors need to be aware of these implications and plan accordingly.

Inheritance Tax Considerations

In some jurisdictions, the value of the deceased estate’s shares might impact inheritance tax calculations. It’s essential for executors to understand these aspects in order to ensure compliance with tax laws.

8. Common Challenges and How to Overcome Them

Selling deceased estate shares can present unique challenges. This section will discuss common issues such as disputed wills, fragmented information about the shares, and market volatility.

Dealing with Disputed Wills and Beneficiary Disagreements

Disputes over the will or disagreements among beneficiaries can complicate the process. Executors must handle these situations delicately and legally.

Managing Market Volatility

Shares can be subject to market fluctuations. Executors should be prepared for this volatility and may need to consult financial advisors to navigate these waters effectively.

9. Tips for Executors Handling Deceased Estate Shares

This section will provide practical advice for executors, including the importance of seeking professional advice, keeping thorough records, and communicating clearly with beneficiaries.

Seeking Professional Financial and Legal Advice

The complexity of selling shares from a deceased estate often necessitates professional advice. This can range from legal counsel to financial advisory services.

Record Keeping and Communication with Beneficiaries

Maintaining transparent and thorough records is crucial. Executors should also prioritize clear and consistent communication with all beneficiaries to avoid misunderstandings.

Conclusion

Selling shares from a deceased estate is a responsibility that requires careful attention to legal, financial, and interpersonal dynamics. By understanding the process, staying informed about tax obligations, and tackling challenges head-on, executors can fulfill their duties effectively and respectfully.

Instagram3 years ago

Instagram3 years agoBuy IG likes and buy organic Instagram followers: where to buy them and how?

Instagram3 years ago

Instagram3 years ago100% Genuine Instagram Followers & Likes with Guaranteed Tool

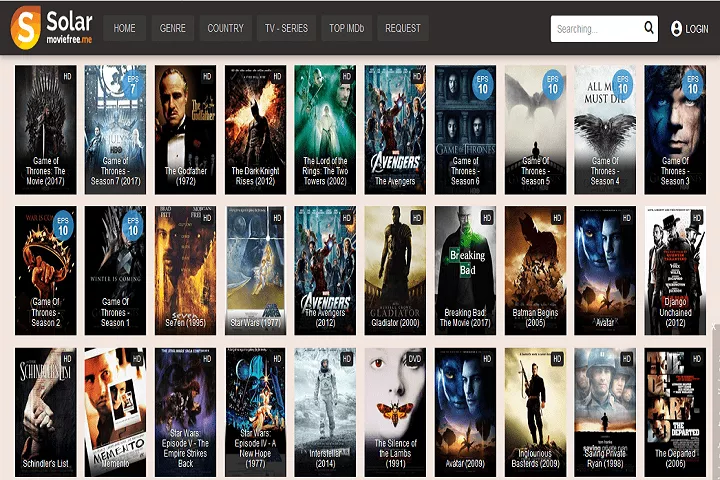

Business5 years ago

Business5 years ago7 Must Have Digital Marketing Tools For Your Small Businesses

Instagram4 years ago

Instagram4 years agoInstagram Followers And Likes – Online Social Media Platform