Business

California Notary by Craig Mullins Consulting

In addition, you will have to pass the California Notary Exam, which is held by the Secretary of State (SOS). In that case, you must indeed aim to become a notary public.

With the multitude of changes brought about by the pandemic, people have been forced to relook at their lives.

All across the world, they have started questioning themselves how they can have a financially stable yet fulfilling career.

The monotonous 9-5 jobs no longer appeal to them, and now they are trying to look for not just one but multiple sources of income.

Freelancing, running side businesses, doing nightly errands, and the likes are a few ways they have started investing their time and resources.

However, it’s not just about the money. People are yearning to work in a way in which they can impact society and do something for the people of their community.

If you, too, are in such a state, pondering if there is any way you can supplement your income and do something for society simultaneously, then there is a unique route for you – get commissioned as a Notary official.

A note also called a notary public or a mobile notary, is a state official appointed by the state who must detect and deter fraudulent transactions and documentation.

In the ordinary course of the functioning of society, many businesses and other types of transactions take place.

In these transactions, there is a scope for fraudulent transactions taking place. Illegal and immoral acts like forgery, theft, fake and coerced agreements and deeds, etc. – tend to occur frequently, detrimental to the judicial system and society.

Here comes a notary in the picture. A notary is like a scanner; they make sure that illegal and fake transactions do not take place. They make sure that;

- The signers show valid identity proof, and the documents, signatures, and stamps are authentic.

- The signers are well aware of the contents of the documents (to avoid exploitation)

- The signers willfully sign the documents and are not under coercion or undue influence.

- Enter the details of the transactions in a record.

Apart from the above functions, notaries also earn handsome money.

Although every state has a regulated price on the notary’s fee, they can earn a lot with the massive number of transactions in today’s world.

California Notary Public

California has seen a tremendous rise in the number of notaries.

There are around 147k California notary officials, among the 4.4 million present in America.

The numbers are likely to go up shortly, and I have begun realizing the gravity of this post.

So, how to be a notary in California? Becoming a notary in California is relatively easy, with very little investment.

If you are eligible (18 years or above, a legal resident of California, and not convicted of any felony), you can apply and get yourself enrolled in the mandatory 6-hour California notary classes.

In addition, you will have to pass the California Notary Exam, which is held by the Secretary of State (SOS).

In the final steps, you will have to sign up for a $15,000 bond and take an oath regarding professional ethics before getting commissioned by the state.

Conclusion

Suppose you are interested in making money through a side gig and desire to have a respectable and influential status in society. In that case, you must indeed aim to become a notary public.

Craig Mullins Consulting

3809 Yosemite Ct N

Pleasanton, CA 94588

(925) 963-2857

Business

Navigating the Process of Selling Deceased Estate Shares

This article aims to provide a comprehensive guide to selling shares from a deceased estate. Process of Selling Deceased Estate Shares.

Table of Contents

1. Understanding the Basics of Selling Deceased Estate Shares

Dealing with a deceased estate can be a challenging and emotional process, especially when it comes to handling financial assets like shares. This article aims to provide a comprehensive guide to selling shares from a deceased estate.

2. What are Deceased Estate Shares?

Deceased estate shares refer to the stocks and shares that were owned by an individual who has passed away. These shares become part of the deceased’s estate and are subject to the terms of their will or estate plan.

3. The Importance of Valuing the Shares

The first step in selling deceased estate shares is to obtain a current valuation. This valuation is crucial for several reasons: it helps in distributing the estate among beneficiaries, it may be necessary for tax purposes, and it gives an idea of the market value of the shares.

4. Legal Requirements and Executor Responsibilities

The executor of the estate plays a pivotal role in the management and distribution of the deceased’s assets. This section will cover the legal responsibilities and steps the executor needs to take to lawfully sell the shares.

5. Obtaining Probate

Before any action can be taken with the shares, it’s often necessary to obtain probate. Probate is a legal process that confirms the executor’s authority to deal with the deceased’s assets.

Transferring Shares into the Executor’s Name

Once probate is granted, shares may need to be transferred into the name of the executor. This process varies depending on the company and the type of shares.

6. The Process of Selling Shares

After completing legal formalities, the executor can proceed with selling the shares. This section will outline the steps involved in this process, including choosing a brokerage or financial service, understanding market conditions, and making informed decisions.

Deciding on the Right Time to Sell

Timing can significantly impact the returns from selling shares. Executors need to consider market conditions and financial advice to determine the best time to sell.

Completing the Sale

This subsection will detail the actual process of selling shares, including placing orders, handling transaction fees, and ensuring all regulatory requirements are met.

7. Navigating Tax Implications and Reporting

Managing tax obligations is a critical aspect of selling deceased estate shares. This section will explain the potential tax implications and the importance of accurate reporting for both capital gains tax and inheritance tax considerations.

Understanding Capital Gains Tax Responsibilities

When shares are sold, any profit made from the time of the deceased’s passing to the sale date may be subject to capital gains tax. Executors need to be aware of these implications and plan accordingly.

Inheritance Tax Considerations

In some jurisdictions, the value of the deceased estate’s shares might impact inheritance tax calculations. It’s essential for executors to understand these aspects in order to ensure compliance with tax laws.

8. Common Challenges and How to Overcome Them

Selling deceased estate shares can present unique challenges. This section will discuss common issues such as disputed wills, fragmented information about the shares, and market volatility.

Dealing with Disputed Wills and Beneficiary Disagreements

Disputes over the will or disagreements among beneficiaries can complicate the process. Executors must handle these situations delicately and legally.

Managing Market Volatility

Shares can be subject to market fluctuations. Executors should be prepared for this volatility and may need to consult financial advisors to navigate these waters effectively.

9. Tips for Executors Handling Deceased Estate Shares

This section will provide practical advice for executors, including the importance of seeking professional advice, keeping thorough records, and communicating clearly with beneficiaries.

Seeking Professional Financial and Legal Advice

The complexity of selling shares from a deceased estate often necessitates professional advice. This can range from legal counsel to financial advisory services.

Record Keeping and Communication with Beneficiaries

Maintaining transparent and thorough records is crucial. Executors should also prioritize clear and consistent communication with all beneficiaries to avoid misunderstandings.

Conclusion

Selling shares from a deceased estate is a responsibility that requires careful attention to legal, financial, and interpersonal dynamics. By understanding the process, staying informed about tax obligations, and tackling challenges head-on, executors can fulfill their duties effectively and respectfully.

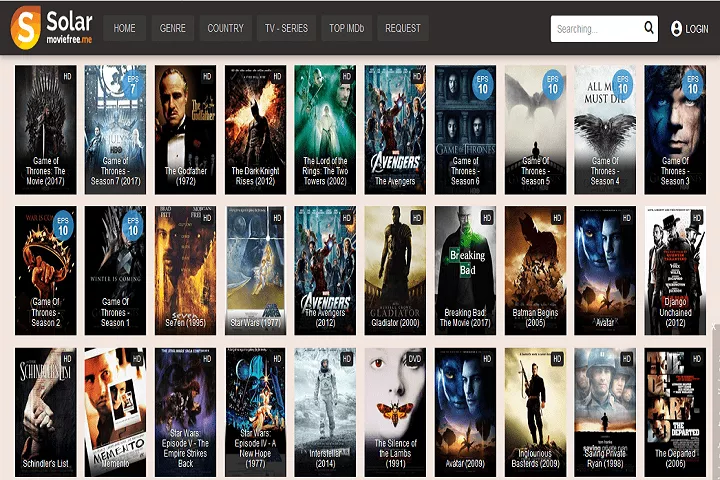

Instagram3 years ago

Instagram3 years agoBuy IG likes and buy organic Instagram followers: where to buy them and how?

Instagram3 years ago

Instagram3 years ago100% Genuine Instagram Followers & Likes with Guaranteed Tool

Business5 years ago

Business5 years ago7 Must Have Digital Marketing Tools For Your Small Businesses

Instagram4 years ago

Instagram4 years agoInstagram Followers And Likes – Online Social Media Platform