Business

How To Use Weekly Time Frame In Forex Trading

Therefore, this article highlights the value of weekly time frames in forex trading and offers tips on how to make the most of them.

Forex traders often overlook the power of the weekly time frame, which may sometimes lead to losses. Trading should be based on longer-term, higher time frames to get a broader view of the price movement and to prevent losses. Therefore, this article highlights the value of weekly time frames in forex trading and offers tips on how to make the most of them. If you have never traded the weekly time frames, you should try it out on a demo account to determine how efficient this strategy is.

Table of Contents

1. What is the Time Frame in Forex Trading?

In Forex trading, the term “time frame” refers to the time interval of a price chart. Depending on the chosen time frame, traders can see varying levels of detail in the price movement. For instance, a daily time frame chart shows one candlestick for each day, while a 1-hour time frame chart shows one candlestick for every hour.

Generally, shorter time frames offer more granular information on price movements, making them ideal for day traders or those who want to make quick trades. In contrast, longer time frames give a wider perspective of market trends and are appropriate for long-term trading plans.

2. How to Use the Weekly Time Frame in Forex Trading?

You must know that when it comes to forex trading, using the weekly time frame can provide you with a long-term perspective that is really valuable to your trading decisions. Every platform, MT4 or MT5, provides you with charting tools where you can seamlessly use the weekly time frames for the best results. This is why you need to understand how to use the weekly time frames while trading currencies.

The first step is to find any long-term patterns or ranges in the currency pair you are trading. Look at price changes over the last three to six months to find any noteworthy trends.

After you’ve determined it, it’s time for you to trade the trend. This may be accomplished by opening positions in the trend’s direction. However, it’s essential to fine-tune your trade entries by going down to lower time frames to ensure you’re entering at the most opportune time.

When there is no trend, and the price is fluctuating, the ideal strategy is trading reversals from support and resistance levels. This entails purchasing at the low and selling at the high end of the spectrum. This means buying at the bottom of the range and selling at the top. However, if there is a trend, buying dips in the trend is usually more profitable than trading breakouts.

3. Why You Should Use the Weekly Time Frame in Forex Trading

Now you know the weekly timeframe and how to use it, but the real question is: Why is it ideal for profitable trading?

The reason is not one but many!

With this effective forex tool, you can determine the long-term trend or range in any currency pair or cross, particularly in the major ones. You may quickly identify the trend’s direction and trade in accordance with it by looking at price movements over the previous three and six months.

In Forex trading, the weekly time period lets you see the larger picture and make sound decisions. It’s easier to judge very long-term price action at a glance, providing a clearer view of the market. It also aids in preventing trading based on erroneous signals, which frequently show on charts with shorter time frames.

Moreover, using a weekly time frame chart doesn’t mean you have to miss out on precise trade entries and exits. To fine-tune your trades and generate more successful outcomes, go down to shorter time frames like the 4-hour or hourly time periods. For instance, you could use the shorter time frames to confirm and time your entry if you see a probable reversal on the weekly chart. To be double sure about your entry and exits, you can use trading calculators to determine potential profits or losses you will make on a trade. This can further help you in risk management.

4. Should You Use Only One Time Frame in Forex Trading?

Using only a one-time frame in Forex trading, whether it be the weekly time frame or any other time frame, is not a smart approach for most traders. A higher time period, such as the weekly price chart, might be useful for spotting long-term patterns, but it needs to be more active and practical to use on its own for making trading choices. We all know that holding a trade open for several weeks or months can result in issues such as broker interest costs and probable market swings.

This is why the majority of expert traders combine several time frames to make better trading decisions. Trading professionals can spot short- and long-term trends and execute accurate entries and exits in the market by keeping an eye on numerous time frames, such as the daily, hourly, and 5-minute time frames.

It is crucial to know that certain forex brokers have time restrictions on trades and that many charge interest for keeping positions open overnight. These factors can eat away at profits, especially for long-term traders. Therefore, combining various time frames and being aware of any possible costs and limits your broker sets is always better.

5. How to Measure Trends with the Weekly Time Frame?

A crucial element of effective Forex trading is trend measurement on a weekly time frame. Traders may evaluate whether the price of a currency pair is more likely to climb or decline over the long run by examining previous forex data. Simply compare the price levels and count back 13 and 26 weeks from the most recent weekly candlestick to generate the best trend indicator.

There is a long-term upswing if the price is greater now than it was earlier. On the other side, you have a long-term decline if the price is lower now than it was earlier. There is no obvious pattern if the results are inconsistent.

This approach is more advantageous than employing intricate forex indicators. Traders can lower their risk of loss and make better trading selections by concentrating on the long-term trend. To create the most accurate forecasts, it’s crucial to keep in mind that this approach is flexible and should be combined with other technical and fundamental analytical tools. Traders may effectively traverse the Forex market and accomplish their trading objectives by combining the appropriate strategies.

6. Final Thoughts

To conclude, if you want to increase your profitability as a forex trader, consider using the weekly time frame to spot patterns and price ranges. Once you’ve determined the state of the market, you may narrow your focus to a shorter time period, such as the 4-hour or 1-hour, to carry out accurate entries and exits and ensure the highest possible profit. Make sure to use a profit calculator to calculate the profits, as it will let you know the exact amount you have made in different currencies.

History has proven that a timeframe of three to six months is the most reliable for spotting trends in the forex market. You may rapidly evaluate if the market is in a long-term uptrend, downturn, or no trend at all by counting back 13 and 26 weeks from the most recent weekly candlestick. However, it’s important to trade without leverage and create a reliable hard stop loss if you simply want to trade the weekly time period. Keep in mind that there is no secret to profitable forex trading, but you may increase your chances with the correct tools and approach.

Business

Navigating the Process of Selling Deceased Estate Shares

This article aims to provide a comprehensive guide to selling shares from a deceased estate. Process of Selling Deceased Estate Shares.

Table of Contents

1. Understanding the Basics of Selling Deceased Estate Shares

Dealing with a deceased estate can be a challenging and emotional process, especially when it comes to handling financial assets like shares. This article aims to provide a comprehensive guide to selling shares from a deceased estate.

2. What are Deceased Estate Shares?

Deceased estate shares refer to the stocks and shares that were owned by an individual who has passed away. These shares become part of the deceased’s estate and are subject to the terms of their will or estate plan.

3. The Importance of Valuing the Shares

The first step in selling deceased estate shares is to obtain a current valuation. This valuation is crucial for several reasons: it helps in distributing the estate among beneficiaries, it may be necessary for tax purposes, and it gives an idea of the market value of the shares.

4. Legal Requirements and Executor Responsibilities

The executor of the estate plays a pivotal role in the management and distribution of the deceased’s assets. This section will cover the legal responsibilities and steps the executor needs to take to lawfully sell the shares.

5. Obtaining Probate

Before any action can be taken with the shares, it’s often necessary to obtain probate. Probate is a legal process that confirms the executor’s authority to deal with the deceased’s assets.

Transferring Shares into the Executor’s Name

Once probate is granted, shares may need to be transferred into the name of the executor. This process varies depending on the company and the type of shares.

6. The Process of Selling Shares

After completing legal formalities, the executor can proceed with selling the shares. This section will outline the steps involved in this process, including choosing a brokerage or financial service, understanding market conditions, and making informed decisions.

Deciding on the Right Time to Sell

Timing can significantly impact the returns from selling shares. Executors need to consider market conditions and financial advice to determine the best time to sell.

Completing the Sale

This subsection will detail the actual process of selling shares, including placing orders, handling transaction fees, and ensuring all regulatory requirements are met.

7. Navigating Tax Implications and Reporting

Managing tax obligations is a critical aspect of selling deceased estate shares. This section will explain the potential tax implications and the importance of accurate reporting for both capital gains tax and inheritance tax considerations.

Understanding Capital Gains Tax Responsibilities

When shares are sold, any profit made from the time of the deceased’s passing to the sale date may be subject to capital gains tax. Executors need to be aware of these implications and plan accordingly.

Inheritance Tax Considerations

In some jurisdictions, the value of the deceased estate’s shares might impact inheritance tax calculations. It’s essential for executors to understand these aspects in order to ensure compliance with tax laws.

8. Common Challenges and How to Overcome Them

Selling deceased estate shares can present unique challenges. This section will discuss common issues such as disputed wills, fragmented information about the shares, and market volatility.

Dealing with Disputed Wills and Beneficiary Disagreements

Disputes over the will or disagreements among beneficiaries can complicate the process. Executors must handle these situations delicately and legally.

Managing Market Volatility

Shares can be subject to market fluctuations. Executors should be prepared for this volatility and may need to consult financial advisors to navigate these waters effectively.

9. Tips for Executors Handling Deceased Estate Shares

This section will provide practical advice for executors, including the importance of seeking professional advice, keeping thorough records, and communicating clearly with beneficiaries.

Seeking Professional Financial and Legal Advice

The complexity of selling shares from a deceased estate often necessitates professional advice. This can range from legal counsel to financial advisory services.

Record Keeping and Communication with Beneficiaries

Maintaining transparent and thorough records is crucial. Executors should also prioritize clear and consistent communication with all beneficiaries to avoid misunderstandings.

Conclusion

Selling shares from a deceased estate is a responsibility that requires careful attention to legal, financial, and interpersonal dynamics. By understanding the process, staying informed about tax obligations, and tackling challenges head-on, executors can fulfill their duties effectively and respectfully.

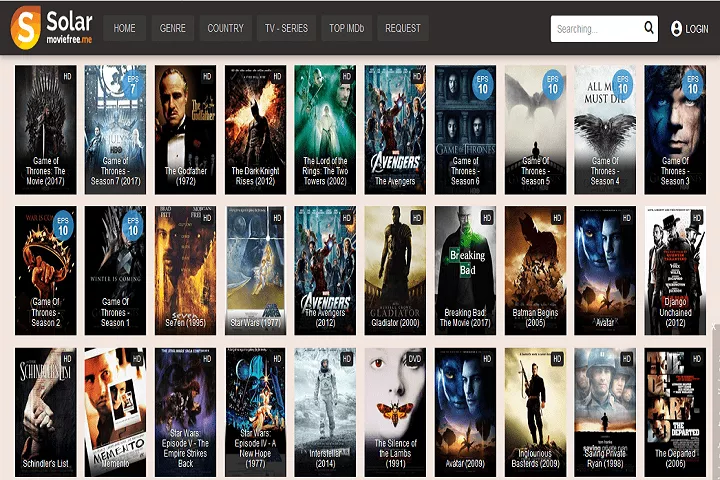

Instagram3 years ago

Instagram3 years agoBuy IG likes and buy organic Instagram followers: where to buy them and how?

Instagram3 years ago

Instagram3 years ago100% Genuine Instagram Followers & Likes with Guaranteed Tool

Business5 years ago

Business5 years ago7 Must Have Digital Marketing Tools For Your Small Businesses

Instagram4 years ago

Instagram4 years agoInstagram Followers And Likes – Online Social Media Platform