Business

The Scope of BA Economics in India

Pursuing an education in BA Economics can help a student choose a career in diverse areas such as banking, insurance, trade, and many others.

Long gone are the days when students got sceptical about whether they should take Economics under BA or not. Earlier, students often took Science or Commerce under societal pressure and ignored the stream BA. But the scenario is quite different today.

Currently, the subject has gained a reputation not just within the country but also across the world. Pursuing an education in BA Economics can help a student choose a career in diverse areas such as banking, insurance, trade, and many others.

Though mostly students earlier used to pursue Economics under B.Com, many students who are not interested in Mathematics take Economics under BA.

Students who have pursued BA in Economics can achieve good positions and earn a handsome salary package in India. If you want to know the curriculum and what all subjects are taught in it, you can check this page.

Some of the best organizations in the country, such as Accenture, HCL Services, Brainfuse, and others, offer good job opportunities to students with a BA economics background.

Career Opportunities in BA Economics

Here are some of the outstanding career opportunities that students can have after pursuing education in BA Economics.

Table of Contents

1. Indian Economic Service:

One of the most acceptable options for pursuing a BA in Economics is to crack the IES exam. It is the Indian Economic Service, after which the candidates get designated at different positions such as planning board, economic affairs, sample survey, and others. This exam comes under the UPSC exam.

2. Budget Analyst:

This particular person looks after the most prominent part of a business that is budget. A budget analyst not just prepared the budget but also analyses it.

3. Economist:

An economist is someone who is hardcore from the field of Economics. Students who are willing to become an economist need to pursue Masters in Economics too. The Reserve Bank of India also selects economists by conducting an entrance exam that a student can appear for.

4. Market Analyst:

As the name suggests, a market analyst analyses the market happenings and then offers different ideas to the company.

5. Research Analysts:

The role of a research analyst is almost similar to a market analyst. The only difference is that a research analyst also analyses many other happenings and offers suggestions.

6. Business Writer:

A business writer can be associated with a media house to generate articles and blogs on different business-related happenings.

7. Business Reporter:

If a student is interested in the media world, he/she can also become a reporter after pursuing a BA economics education.

8. HR Manager:

While many companies will prefer to have someone from an MBA background to handle his profile, many other companies may consider a BA Economics student for this position. An HR manager’s role is to take candidates and understand different policies and financial matters related to the candidates.

9. Operations Manager:

A candidate from the background of BA Economics also can get a job option as the Operations Manager of a company.

10. Project Manager:

Handling an entire project is not an easy task. There should be someone who does not just know the process but also about the financial, demand and supply, and other methods. Hence, someone who has a background of BA in Economics is an excellent choice for this position.

11. Consultant:

Candidates can become consultants to provide economic consultancy to companies in place of working for a particular company.

12. Forecaster:

A forecaster is someone who checks and analyses past and present data and trends to analyze customer behaviour, the demand of a product, and other elements and predicts what can happen next. Based on such predictions, companies make arrangements and get ready for the upcoming happenings.

13. Business Lawyer:

If the student has pursued BA Economics and wishes to enter the field of law, he/she can do so by further pursuing BA LLB. One of the advantages that a student gets is the specialization as he/she can conveniently become a business lawyer.

14. Cost Analyst:

Costing is a significant element in any business. A cost analyst analyses the present market and other trends to offer a picture of what has to be done ahead.

15. Investment Administrator:

An investment administrator has a significant role in investment companies. They handle the accounts of the investors, create portfolios, and others.

16. Customer Profit Analyst:

This is a very innovative position that is now highly in demand in companies. The customer profit analyst checks out different types of customers from the past and presents records to analyze which customers are profitable.

17. Regulatory Affairs Analyst:

Most companies have a regulatory affairs analyst who takes care of the regulatory deadlines and related activities. They work closely with the compliance officers so that the company does not have to face any trouble in the regulatory division.

18. Banker:

Candidates can also serve as bankers in different positions in Indian or any of the international banks. They can become a bank manager or a development officer. Many candidates can also get into a much higher position, such as an investment banker.

19. Actuary:

An actuary is a crucial part of any business team. It is the person who analyses several financial and other elements to predict any threats or risks in the future. An actuary can be said to be a person who prepares the team for any upcoming threats and is responsible for risk management activities.

There are many other career opportunities as well after completing BA economics in India. On average, someone who has a background in BA Economics can have a decent start and can have an initial salary package of 1.5 lakhs per annum to 2 lakhs per annum. The salary package increases according to the candidate’s position and the company in which the person is joining. The salary package can go up to 14.8 lakhs per annum and more.

Business

Navigating the Process of Selling Deceased Estate Shares

This article aims to provide a comprehensive guide to selling shares from a deceased estate. Process of Selling Deceased Estate Shares.

Table of Contents

1. Understanding the Basics of Selling Deceased Estate Shares

Dealing with a deceased estate can be a challenging and emotional process, especially when it comes to handling financial assets like shares. This article aims to provide a comprehensive guide to selling shares from a deceased estate.

2. What are Deceased Estate Shares?

Deceased estate shares refer to the stocks and shares that were owned by an individual who has passed away. These shares become part of the deceased’s estate and are subject to the terms of their will or estate plan.

3. The Importance of Valuing the Shares

The first step in selling deceased estate shares is to obtain a current valuation. This valuation is crucial for several reasons: it helps in distributing the estate among beneficiaries, it may be necessary for tax purposes, and it gives an idea of the market value of the shares.

4. Legal Requirements and Executor Responsibilities

The executor of the estate plays a pivotal role in the management and distribution of the deceased’s assets. This section will cover the legal responsibilities and steps the executor needs to take to lawfully sell the shares.

5. Obtaining Probate

Before any action can be taken with the shares, it’s often necessary to obtain probate. Probate is a legal process that confirms the executor’s authority to deal with the deceased’s assets.

Transferring Shares into the Executor’s Name

Once probate is granted, shares may need to be transferred into the name of the executor. This process varies depending on the company and the type of shares.

6. The Process of Selling Shares

After completing legal formalities, the executor can proceed with selling the shares. This section will outline the steps involved in this process, including choosing a brokerage or financial service, understanding market conditions, and making informed decisions.

Deciding on the Right Time to Sell

Timing can significantly impact the returns from selling shares. Executors need to consider market conditions and financial advice to determine the best time to sell.

Completing the Sale

This subsection will detail the actual process of selling shares, including placing orders, handling transaction fees, and ensuring all regulatory requirements are met.

7. Navigating Tax Implications and Reporting

Managing tax obligations is a critical aspect of selling deceased estate shares. This section will explain the potential tax implications and the importance of accurate reporting for both capital gains tax and inheritance tax considerations.

Understanding Capital Gains Tax Responsibilities

When shares are sold, any profit made from the time of the deceased’s passing to the sale date may be subject to capital gains tax. Executors need to be aware of these implications and plan accordingly.

Inheritance Tax Considerations

In some jurisdictions, the value of the deceased estate’s shares might impact inheritance tax calculations. It’s essential for executors to understand these aspects in order to ensure compliance with tax laws.

8. Common Challenges and How to Overcome Them

Selling deceased estate shares can present unique challenges. This section will discuss common issues such as disputed wills, fragmented information about the shares, and market volatility.

Dealing with Disputed Wills and Beneficiary Disagreements

Disputes over the will or disagreements among beneficiaries can complicate the process. Executors must handle these situations delicately and legally.

Managing Market Volatility

Shares can be subject to market fluctuations. Executors should be prepared for this volatility and may need to consult financial advisors to navigate these waters effectively.

9. Tips for Executors Handling Deceased Estate Shares

This section will provide practical advice for executors, including the importance of seeking professional advice, keeping thorough records, and communicating clearly with beneficiaries.

Seeking Professional Financial and Legal Advice

The complexity of selling shares from a deceased estate often necessitates professional advice. This can range from legal counsel to financial advisory services.

Record Keeping and Communication with Beneficiaries

Maintaining transparent and thorough records is crucial. Executors should also prioritize clear and consistent communication with all beneficiaries to avoid misunderstandings.

Conclusion

Selling shares from a deceased estate is a responsibility that requires careful attention to legal, financial, and interpersonal dynamics. By understanding the process, staying informed about tax obligations, and tackling challenges head-on, executors can fulfill their duties effectively and respectfully.

Instagram3 years ago

Instagram3 years agoBuy IG likes and buy organic Instagram followers: where to buy them and how?

Instagram3 years ago

Instagram3 years ago100% Genuine Instagram Followers & Likes with Guaranteed Tool

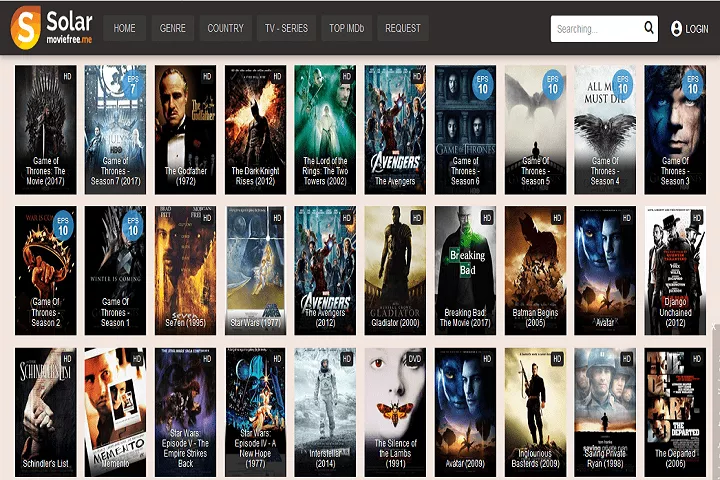

Business5 years ago

Business5 years ago7 Must Have Digital Marketing Tools For Your Small Businesses

Instagram4 years ago

Instagram4 years agoInstagram Followers And Likes – Online Social Media Platform