Business

A Peek into Best Online Form Builders

To develop the best online forms, we can make use of the following tools. A peek into best online form builders.

To develop the best online forms, we can make use of the following tools:

- Google Forms for rapidly making great forms for free.

- Microsoft Forms for gathering and dissecting form results in Excel.

- Typeform for conversational information assortment.

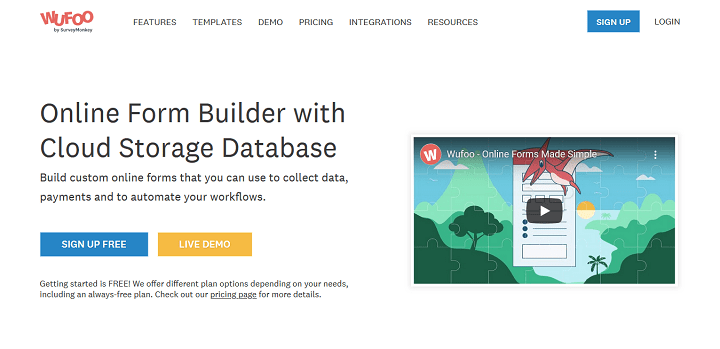

- Wufoo for quickly making graphical reports without spreadsheets.

- JotForm for making templated forms.

- Formstack for directed organizations.

- Paperform for making forms that resemble presentation pages.

- Formsite for ensuring sensitive information.

- Formbakery for facilitating arrangements on your server.

Table of Contents

1. What makes a great online form builder?

You make labels and inquiries for the snippets of data you’re hoping to gather, and respondents can give that data through freestyle text boxes, dropdowns, radio catches, etc. You can likewise set specific fields as required or discretionary and limit the sorts of reactions you get to have more power over the information you gather.

Even though building structures and gathering reactions is an exact cycle, form applications come in all shapes and sizes. There are primary, independent from applications, form developers, incorporated with spreadsheet applications, and progressed information preparing devices that end up being worked around forms.

What makes an extraordinary online form manufacturer? The apparatuses are:

- Sufficiently adaptable to make anything from a basic contact structure to a nitty-gritty, multi-page study.

- Basic and quick to utilize so you can construct a structure in less than five minutes.

- They are intended to take a shot at any site.

2. Google Forms for rapidly making great forms for free:

Google Forms is a distinctive form of developer application for some reasons. To start with, it’s completely free; you need a Google record to utilize it. Second, it naturally spares your form results to a Google Sheets spreadsheet for cutting edge investigation.

At long last, it’s extraordinarily quick: adding and altering form fields in the Google Forms proofreader is discernibly quicker than utilizing practically some other form application.

3. Microsoft Forms for gathering and dissecting form results in Excel:

If you favour Excel over Google Sheets, Microsoft Forms may better suit your inclinations. Microsoft Forms is Microsoft’s response to Google Forms, and it generally works similarly, yet with more information investigation usefulness on account of its incorporation with Excel.

4. Typeform for conversational information assortment:

Typeform throws away the old shows of a long page of inquiries and reaction fields. Typeform’s forms are interestingly planned, giving each question in turn and obscuring out the others, causing the accommodation cycle’s general condition to feel conversational and personal.

Respondents can tap an assigned key on their consoles to choose different decision choices, type to figure out dropdown menu alternatives, and press Enter to bounce to the following field.

5. Wufoo for rapidly making graphical reports without spreadsheets:

Wufoo was one of the primary form apparatuses to make online forms look great. It’s also essential for SurveyMonkey, one of the soonest web applications with a set of experiences going back to 1999. What Wufoo needs lacks in modern aesthetics, it compensates for with outrageous adaptability.

While forms made in Google Forms and Microsoft Forms all will, in general, look a lot of the same, Wufoo lets you assemble a distinctive way.

6. JotForm for making templated forms:

JotForm lets you manufacture a free form that does all you require it to do and looks precisely how you need it to look. JotForm’s forms are considerably more adjustable than arrangements made on Google Forms and Microsoft Forms, and not at all like Wufoo, JotForm even lets you do things like acknowledge instalments and gather marks without moving up to an excellent arrangement.

7. Formstack for directed organizations:

Formstack offers explicit HIPAA-and GDPR-consistent forms that keep respondents’ confidential information secure. Moreover, Formstack will caution you if your state doesn’t satisfy Section 508 Compliance guidelines—e.g., they won’t work with assistive advancements like screen readers—guaranteeing everybody can round your forms out.

8. Paperform for making forms that resemble presentation pages:

With Paperform, forms look more like a greeting page or blog entry than your standard rundown of form fields. Include photographs, headings, video, and long-form text to utilize your form to recount the story behind your contributions.

9. Formsite for ensuring sensitive information:

Formsite lets you encode the content in explicit form fields. That implies it scrambles it, so reactions seem muddled to individuals without authorization to see them. It accompanies worked in instalment preparing incorporations like PayPal, Stripe, and Authorize.net, or you can utilize encoded fields to acknowledge charge card or ACH information through your form legitimately.

10. Formbakery for facilitating forms on your server:

Formbakery gives you the source code for you to have your forms on your worker. This implies that once you get the code, you don’t need to depend on Formbakery by any stretch of the imagination—if they somehow happened to vanish, your forms would, in any case, remain unblemished.

There may be many best online form builders, but these are the perfect ones.

Business

Navigating the Process of Selling Deceased Estate Shares

This article aims to provide a comprehensive guide to selling shares from a deceased estate. Process of Selling Deceased Estate Shares.

Table of Contents

1. Understanding the Basics of Selling Deceased Estate Shares

Dealing with a deceased estate can be a challenging and emotional process, especially when it comes to handling financial assets like shares. This article aims to provide a comprehensive guide to selling shares from a deceased estate.

2. What are Deceased Estate Shares?

Deceased estate shares refer to the stocks and shares that were owned by an individual who has passed away. These shares become part of the deceased’s estate and are subject to the terms of their will or estate plan.

3. The Importance of Valuing the Shares

The first step in selling deceased estate shares is to obtain a current valuation. This valuation is crucial for several reasons: it helps in distributing the estate among beneficiaries, it may be necessary for tax purposes, and it gives an idea of the market value of the shares.

4. Legal Requirements and Executor Responsibilities

The executor of the estate plays a pivotal role in the management and distribution of the deceased’s assets. This section will cover the legal responsibilities and steps the executor needs to take to lawfully sell the shares.

5. Obtaining Probate

Before any action can be taken with the shares, it’s often necessary to obtain probate. Probate is a legal process that confirms the executor’s authority to deal with the deceased’s assets.

Transferring Shares into the Executor’s Name

Once probate is granted, shares may need to be transferred into the name of the executor. This process varies depending on the company and the type of shares.

6. The Process of Selling Shares

After completing legal formalities, the executor can proceed with selling the shares. This section will outline the steps involved in this process, including choosing a brokerage or financial service, understanding market conditions, and making informed decisions.

Deciding on the Right Time to Sell

Timing can significantly impact the returns from selling shares. Executors need to consider market conditions and financial advice to determine the best time to sell.

Completing the Sale

This subsection will detail the actual process of selling shares, including placing orders, handling transaction fees, and ensuring all regulatory requirements are met.

7. Navigating Tax Implications and Reporting

Managing tax obligations is a critical aspect of selling deceased estate shares. This section will explain the potential tax implications and the importance of accurate reporting for both capital gains tax and inheritance tax considerations.

Understanding Capital Gains Tax Responsibilities

When shares are sold, any profit made from the time of the deceased’s passing to the sale date may be subject to capital gains tax. Executors need to be aware of these implications and plan accordingly.

Inheritance Tax Considerations

In some jurisdictions, the value of the deceased estate’s shares might impact inheritance tax calculations. It’s essential for executors to understand these aspects in order to ensure compliance with tax laws.

8. Common Challenges and How to Overcome Them

Selling deceased estate shares can present unique challenges. This section will discuss common issues such as disputed wills, fragmented information about the shares, and market volatility.

Dealing with Disputed Wills and Beneficiary Disagreements

Disputes over the will or disagreements among beneficiaries can complicate the process. Executors must handle these situations delicately and legally.

Managing Market Volatility

Shares can be subject to market fluctuations. Executors should be prepared for this volatility and may need to consult financial advisors to navigate these waters effectively.

9. Tips for Executors Handling Deceased Estate Shares

This section will provide practical advice for executors, including the importance of seeking professional advice, keeping thorough records, and communicating clearly with beneficiaries.

Seeking Professional Financial and Legal Advice

The complexity of selling shares from a deceased estate often necessitates professional advice. This can range from legal counsel to financial advisory services.

Record Keeping and Communication with Beneficiaries

Maintaining transparent and thorough records is crucial. Executors should also prioritize clear and consistent communication with all beneficiaries to avoid misunderstandings.

Conclusion

Selling shares from a deceased estate is a responsibility that requires careful attention to legal, financial, and interpersonal dynamics. By understanding the process, staying informed about tax obligations, and tackling challenges head-on, executors can fulfill their duties effectively and respectfully.

-

Instagram4 years ago

Instagram4 years agoBuy IG likes and buy organic Instagram followers: where to buy them and how?

-

Instagram4 years ago

Instagram4 years ago100% Genuine Instagram Followers & Likes with Guaranteed Tool

-

Business5 years ago

Business5 years ago7 Must Have Digital Marketing Tools For Your Small Businesses

-

Instagram4 years ago

Instagram4 years agoInstagram Followers And Likes – Online Social Media Platform