Business

Tax Filing Advice: Self-employment Tax (IRS Form 1040)

In this post, we’ll show you how to fill out Form 1040 and offer some tips on how to minimize your tax obligations. Tax Filing Advice – Self-employment Tax – IRS Form 1040.

Filing your taxes can be challenging, especially if you are a freelancer. As a freelancer, you are required to pay self-employment tax, maintain track of your revenues and expenses, and submit projected tax payments throughout the year. You can complete an IRS Form 1040 with a little help and a quarterly tax calculator, despite the fact that it could appear challenging. In this post, we’ll show you how to fill out Form 1040 and offer some tips on how to minimize your tax obligations.

Table of Contents

1. Assemble Your Papers

Before you start filling out your Form 1040, you must gather all the necessary information and paperwork. Your W-2s, 1099s for any freelance work you did, receipts for any anticipated tax deductions, and any other financial records you might have are included in this. You must also include your Social Security number and the Social Security numbers of any dependents you wish to claim.

2. Verify Your Filing’s Status

Your file status affects your tax rate and the size of your standard deduction. Determine which filing status is appropriate for you based on your marital status, the number of dependents you have, and other factors.

3. Ascertain your income

Your total income for the tax year is what is referred to as your gross income. This includes all forms of income, including wages, salaries, tips, and revenue from side jobs. Add up your income for the tax year and gather all of your supporting papers. List all of your sources of income from contract work.

4. Remove Your Modifications

By deducting adjustments from your gross income, you can reduce your taxable income. They also pay your health insurance premiums, student loan interest, and IRA contributions if you work for yourself.

5. Choose Your Tax Savings

By taking some expenses out of your taxable income, you can reduce it. The two distinct types of tax deductions are standard and itemized. The standard deduction is an agreed-upon sum of money that is available to all tax filers. As itemized deductions, you are allowed to deduct some costs like state and local taxes, charity giving, and mortgage interest. It is better to select the tax deduction that would result in the greatest financial savings.

6. In Step Six, determine your taxable income.

After subtracting either your standard deduction or your itemized deduction from your AGI, your taxable income will be determined. According to federal law, this amount is your taxable income.

7. Choose Your Tax Credits

They are made up of education, earned income, and child tax credits. To reduce your tax obligation, find out which tax credits you are eligible for.

8. Find Out How Much Tax You Owe

Your overall tax liabilities, less any payments or credits, are referred to as your tax burden.

9. Verify Your Upcoming Tax Payments

If you are self-employed, you must make estimated tax payments throughout the year. Check your expected tax payments throughout the year to ensure you made the required amount to avoid underpayment penalties.

10. Finishing Schedule C

Schedule C, the relevant form, is used to report your self-employment earnings and expenses. To calculate your self-employment tax, which is based on your net self-employment income, use Schedule C. In addition to this, you will also owe regular income tax.

11. Add Up Your Credits and Payments

Add all of your year-end payments, such as estimated tax payments and any taxes you have withheld from your pay. If you qualify, take a deduction for any tax credits. Here, your overall payments and credits will be displayed.

12. Figure out whether you owe a refund or are due one.

You should evaluate your entire tax burden in relation to your total payments and credits. If your tax due is greater than the sum of your payments and credits, you will be obliged to pay extra tax.

13. Upload Your Return

When you’ve finished filling out Form 1040 and any necessary attachments, sign and date your return, and then send it to the relevant IRS address. Make sure to keep a copy of your return and any supporting documents for your records.

14. Tips on How to Cut Your Taxes as Much as Possible

Now that you know how, let’s speak about how to complete Form 1040 so that you may maximize your tax savings as a freelancer.

Using tax deductions is a smart move.

As a freelancer, you might be eligible to write off a range of expenses from your self-employment taxes, such as business travel, office supplies, and office equipment. Keep note of all your expenses throughout the year in order to maximize any relevant deductions.

Submit projected tax payments

As was previously stated, self-employed individuals are obligated to make projected tax payments throughout the year. This allows you to keep track of your tax obligations and prevent underpayment fines.

You May Want To Add

The ability to deduct more business expenses and a lower tax rate on self-employment income are just two of the additional tax benefits that incorporating your freelancing business may offer. Speak with a tax professional if you’re unsure if incorporation is the right option for you.

Employ tax-favored retirement accounts.

You may be able to reduce your taxable income and increase your tax savings by contributing to tax-advantaged retirement plans like an IRA or Solo 401(k). Use these accounts if you meet the requirements.

Conclusion

Although filling out a Form 1040 can be intimidating, with a little planning and assistance, it is actually rather easy. Even though you may face certain challenges as a freelancer when attempting to maximize your tax savings, there are a number of strategies you may employ to help minimize your tax burden. By taking advantage of tax deductions, paying expected taxes, considering incorporation, and using tax-advantaged retirement plans, you may keep more of your hard-earned money in your pocket.

Business

Navigating the Process of Selling Deceased Estate Shares

This article aims to provide a comprehensive guide to selling shares from a deceased estate. Process of Selling Deceased Estate Shares.

Table of Contents

1. Understanding the Basics of Selling Deceased Estate Shares

Dealing with a deceased estate can be a challenging and emotional process, especially when it comes to handling financial assets like shares. This article aims to provide a comprehensive guide to selling shares from a deceased estate.

2. What are Deceased Estate Shares?

Deceased estate shares refer to the stocks and shares that were owned by an individual who has passed away. These shares become part of the deceased’s estate and are subject to the terms of their will or estate plan.

3. The Importance of Valuing the Shares

The first step in selling deceased estate shares is to obtain a current valuation. This valuation is crucial for several reasons: it helps in distributing the estate among beneficiaries, it may be necessary for tax purposes, and it gives an idea of the market value of the shares.

4. Legal Requirements and Executor Responsibilities

The executor of the estate plays a pivotal role in the management and distribution of the deceased’s assets. This section will cover the legal responsibilities and steps the executor needs to take to lawfully sell the shares.

5. Obtaining Probate

Before any action can be taken with the shares, it’s often necessary to obtain probate. Probate is a legal process that confirms the executor’s authority to deal with the deceased’s assets.

Transferring Shares into the Executor’s Name

Once probate is granted, shares may need to be transferred into the name of the executor. This process varies depending on the company and the type of shares.

6. The Process of Selling Shares

After completing legal formalities, the executor can proceed with selling the shares. This section will outline the steps involved in this process, including choosing a brokerage or financial service, understanding market conditions, and making informed decisions.

Deciding on the Right Time to Sell

Timing can significantly impact the returns from selling shares. Executors need to consider market conditions and financial advice to determine the best time to sell.

Completing the Sale

This subsection will detail the actual process of selling shares, including placing orders, handling transaction fees, and ensuring all regulatory requirements are met.

7. Navigating Tax Implications and Reporting

Managing tax obligations is a critical aspect of selling deceased estate shares. This section will explain the potential tax implications and the importance of accurate reporting for both capital gains tax and inheritance tax considerations.

Understanding Capital Gains Tax Responsibilities

When shares are sold, any profit made from the time of the deceased’s passing to the sale date may be subject to capital gains tax. Executors need to be aware of these implications and plan accordingly.

Inheritance Tax Considerations

In some jurisdictions, the value of the deceased estate’s shares might impact inheritance tax calculations. It’s essential for executors to understand these aspects in order to ensure compliance with tax laws.

8. Common Challenges and How to Overcome Them

Selling deceased estate shares can present unique challenges. This section will discuss common issues such as disputed wills, fragmented information about the shares, and market volatility.

Dealing with Disputed Wills and Beneficiary Disagreements

Disputes over the will or disagreements among beneficiaries can complicate the process. Executors must handle these situations delicately and legally.

Managing Market Volatility

Shares can be subject to market fluctuations. Executors should be prepared for this volatility and may need to consult financial advisors to navigate these waters effectively.

9. Tips for Executors Handling Deceased Estate Shares

This section will provide practical advice for executors, including the importance of seeking professional advice, keeping thorough records, and communicating clearly with beneficiaries.

Seeking Professional Financial and Legal Advice

The complexity of selling shares from a deceased estate often necessitates professional advice. This can range from legal counsel to financial advisory services.

Record Keeping and Communication with Beneficiaries

Maintaining transparent and thorough records is crucial. Executors should also prioritize clear and consistent communication with all beneficiaries to avoid misunderstandings.

Conclusion

Selling shares from a deceased estate is a responsibility that requires careful attention to legal, financial, and interpersonal dynamics. By understanding the process, staying informed about tax obligations, and tackling challenges head-on, executors can fulfill their duties effectively and respectfully.

Instagram3 years ago

Instagram3 years agoBuy IG likes and buy organic Instagram followers: where to buy them and how?

Instagram3 years ago

Instagram3 years ago100% Genuine Instagram Followers & Likes with Guaranteed Tool

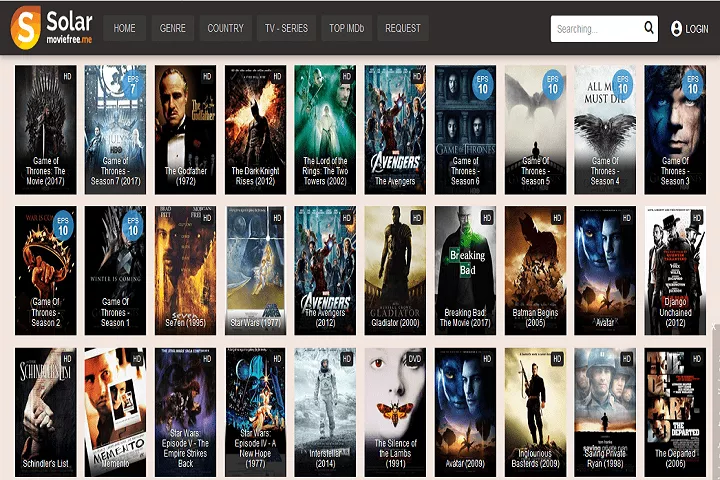

Business5 years ago

Business5 years ago7 Must Have Digital Marketing Tools For Your Small Businesses

Instagram4 years ago

Instagram4 years agoInstagram Followers And Likes – Online Social Media Platform