Cybersecurity

How you can support your workers while they better their education

It is an excellent idea to support your workers while bettering their education and even encouraging good progress. Support can come in various ways.

It is an excellent idea to support your workers while bettering their education and even encouraging good progress. Support can come in various ways: from just being flexible within their timetable at work and moving their working hours around to suit their learning, to even paying for their courses and taking a genuine interest in their progression.

Indeed, it will highly benefit your business to have workers learn different job roles or increase their knowledge within one specific area so that they become specialists. It will mean that you will be able to pass this new knowledge to your customers, who will, in turn, either be happy to pay more for a more specialist service or will feel more confident with your business and the supplies that you provide for them whether it is in products or services.

1. Train in-house where possible

Where possible, you can aid your worker’s education within their current job roles by offering them in-house training to understand what they are doing and how they are affecting your business.

In providing good quality in-house training to your workers, you will be benefiting your own business as you will find that quality, production speed, and confidence excel – meaning there will be fewer mistakes or bad decisions based on lack of knowledge made.

2. Invest in their learning

If you cannot offer everything that needs to be provided in-house, then the next best thing you can do is invest in their learning. For instance, if you pay for your workers’ training programs, you will invest in their education.

You will not need to worry about losing a worker for part of a week while attending college or university (unless you have paid for this kind of program). There are plenty of good quality training programs available online.

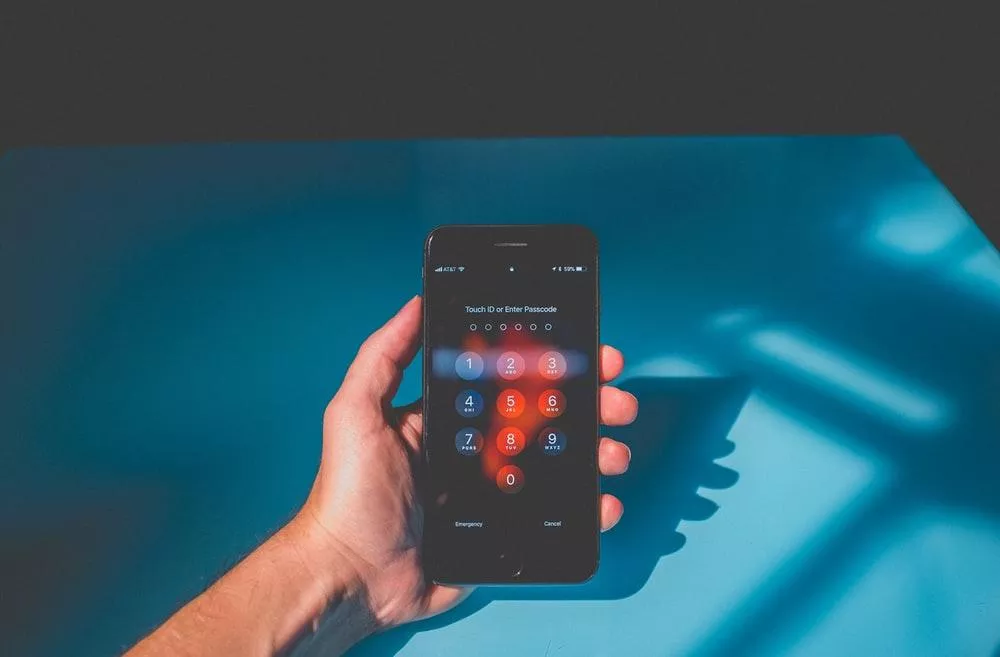

However, you will have to look at what programs will benefit your business the most and offer them to your workers (for instance, online cyber security programs) rather than just offering to pay for any training programs your workers want to participate in. Cybersecurity is one of those things you can’t cut corners on, so having as many of your employees in the know as possible is no bad thing,

3. Provide a career ladder within your business

You may feel that you do not want to offer training programs to your workers for fear that they will take the program, pass and then seek job roles within other businesses, leaving you with the bill and no worker to carry out the work. This indeed may be true in some cases.

To make this a rare occurrence, you will have to offer your workers a career ladder within your business or such perks that they will be more willing to stay after completing the program than seek employment elsewhere.

These incentives could in a pay increase, a promotion, a company vehicle, or the chance to progress their career further by offering them additional training programs and providing them with the experience they desire.

Blockchain

Perché Dobbiamo Utilizzare Un’Applicazione Antivirus Su Android?

Perché Dobbiamo Utilizzare Un’applicazione Antivirus Su Android? Rischi diversi, Vantaggi dell’utilizzo di applicazioni antivirus su Android

Una soluzione altrettanto fondamentale per garantire che il tuo dispositivo non venga infettato da questi programmi software malevoli (virus, trojan, adware, spyware) è il programma antivirus. Di conseguenza, il codice rileva e respinge anche l’app che può essere sviluppata in modo inefficiente dagli hacker. L’altra virtù è che può anche aiutare la tua macchina a essere sotto tiro e prevenire altri attacchi informatici da attacchi di phishing.

1. Rischi diversi

Android, essendo il sistema operativo mobile più utilizzato a livello globale, è diventato un obiettivo primario per i criminali informatici. Dal malware e ransomware agli attacchi di phishing e al furto di identità, le minacce sono diverse e in continua evoluzione. A differenza dei computer tradizionali, i dispositivi mobili spesso non dispongono delle solide misure di sicurezza inerenti ai sistemi operativi desktop, rendendoli suscettibili di sfruttamento.

a. Minaccia malware

Il malware, abbreviazione di software dannoso, comprende un ampio spettro di minacce progettate per infiltrarsi, interrompere o danneggiare un dispositivo o una rete. Nel regno di Android, i malware possono mascherarsi da applicazioni legittime, nascondersi negli app store o mascherarsi da download innocui dal web. Una volta installato, il malware può provocare danni rubando informazioni sensibili, spiando le attività degli utenti o addirittura rendendo il dispositivo inutilizzabile.

b. Insidie del phishing

Gli attacchi di phishing, un’altra minaccia diffusa, mirano a indurre gli utenti a divulgare informazioni personali come password, numeri di carta di credito o credenziali di accesso. Questi attacchi spesso utilizzano tattiche di ingegneria sociale, sfruttando siti Web, e-mail o messaggi falsi per ingannare le vittime ignare. Con la comodità di accedere alla posta elettronica e navigare sul Web sui nostri dispositivi Android, il rischio di cadere preda di truffe di phishing diventa sempre presente.

2. Vantaggi dell’utilizzo di applicazioni antivirus su Android

a. Il ruolo delle applicazioni antivirus

Le applicazione antivirus gratuita per Android si rivelano indispensabili guardiani della nostra sicurezza digitale di fronte a queste minacce incombenti. Queste soluzioni software sono progettate specificamente per rilevare, prevenire ed eliminare programmi dannosi, rafforzando così le difese dei nostri dispositivi Android.

b. Protezione in tempo reale

Le applicazioni antivirus utilizzano algoritmi sofisticati e analisi euristiche per identificare e neutralizzare proattivamente le minacce in tempo reale. Monitorando continuamente le attività del dispositivo e i flussi di dati in entrata, questi strumenti fungono da sentinelle vigili, intercettando il malware prima che possa infiltrarsi nel sistema.

c. Scansione completa

Una delle funzioni principali delle applicazioni antivirus è l’esecuzione di scansioni complete della memoria, delle applicazioni e dei file del dispositivo. Attraverso tecniche di scansione approfondita, questi strumenti ispezionano meticolosamente ogni angolo del dispositivo, eliminando ogni traccia di malware o attività sospette. Eseguendo scansioni regolari, gli utenti possono garantire che i loro dispositivi Android rimangano liberi da minacce nascoste.

d. protezione della rete

In un’era in cui la navigazione sul Web è diventata parte integrante della nostra vita quotidiana, le applicazioni antivirus estendono il loro ombrello protettivo per comprendere le attività online. Integrando funzionalità di protezione Web, questi strumenti possono rilevare e bloccare siti Web dannosi, tentativi di phishing e altre minacce online in tempo reale. Che si tratti di fare acquisti, operazioni bancarie o semplicemente navigare sul Web alla ricerca di informazioni, gli utenti possono navigare nel panorama digitale con sicurezza, sapendo che la loro applicazione antivirus è al loro fianco.

e. Misure antifurto

Oltre a combattere malware e minacce online, molte applicazioni antivirus offrono funzionalità aggiuntive come funzionalità antifurto e generatore di password sicuro. In caso di smarrimento o furto del dispositivo, questi strumenti consentono agli utenti di localizzare, bloccare o cancellare da remoto il proprio dispositivo Android, proteggendo i dati sensibili dalla caduta nelle mani sbagliate. Grazie alla possibilità di tracciare la posizione del dispositivo o attivare un allarme da remoto, gli utenti possono mitigare le potenziali conseguenze del furto o dello smarrimento del dispositivo.

f. Reputazione e affidabilità

Quando si valutano le applicazioni antivirus, è essenziale considerare la reputazione e il track record dello sviluppatore del software. Scegli marchi affermati con una comprovata storia nella fornitura di soluzioni di sicurezza affidabili e aggiornamenti tempestivi. Leggere recensioni e testimonianze di altri utenti può fornire preziose informazioni sull’efficacia e sulle prestazioni dell’applicazione antivirus.

g. Impatto sulle prestazioni

Sebbene le applicazioni antivirus svolgano un ruolo cruciale nella protezione del tuo dispositivo Android, non dovrebbero andare a scapito delle prestazioni o della durata della batteria. Scegli soluzioni leggere e ottimizzate che riducono al minimo il consumo di risorse e funzionano perfettamente in background. Evita applicazioni eccessive che consumano le risorse di sistema o causano rallentamenti, poiché possono compromettere l’esperienza dell’utente.

Conclusione

Le applicazioni antivirus fungono da guardiani indispensabili, proteggendo la nostra oasi digitale da malware, attacchi di phishing e altre attività nefaste. Protezione Web e misure antifurto: questi strumenti consentono agli utenti di navigare nel panorama digitale con sicurezza e tranquillità. Mentre abbracciamo le infinite possibilità offerte dai nostri dispositivi Android, non dimentichiamoci di rafforzare le loro difese con l’armatura della protezione antivirus.

Instagram3 years ago

Instagram3 years agoBuy IG likes and buy organic Instagram followers: where to buy them and how?

Instagram3 years ago

Instagram3 years ago100% Genuine Instagram Followers & Likes with Guaranteed Tool

Business4 years ago

Business4 years ago7 Must Have Digital Marketing Tools For Your Small Businesses

Instagram3 years ago

Instagram3 years agoInstagram Followers And Likes – Online Social Media Platform