Business

What is a Customer Data Platform?

Consolidating real-time data sources, linking them to a customer profile, and making them instantly deployable in a campaign gives a CDP a great chance of winning over your present marketing team members.

A customer Data Platform (CDP) is a new approach to centralizing your business’s promotional and sales information. Learn how companies use CDP to get ahead of the competition and effectively address their clients.

Table of Contents

1. Understanding a Customer Data Platform

A customer data platform stores and organizes customer information in one place, making it accessible to various customer care, sales, and marketing departments. The software can do its functions because it compiles information from multiple channels, such as your company’s social media profiles, website statistics, and live chat sessions.

You may best analyze your consumer’s needs and produce more targeted marketing campaigns with a customer data platform. Your marketing and sales activities will be more efficient, saving you time and resources. The advertising, sales and other teams that you manage will be able to make more informed decisions with the help of detailed prospective customers.

2. Reasons Why Businesses Should Implement a Customer Data Platform

A customer data platform is essential for modern businesses for many reasons.

The Elimination of Third-Party Cookies

Given the development of privacy rules and the shifting security expectations of consumers, marketing methods dependent on cookies set by third parties are becoming more unsustainable.

First-party consumer data, collected directly from your clientele, is the new gold standard. You may better serve your clients’ individual needs by creating a unified database of their information and using that information to send them tailored messages. By adjusting to the world of first-party cookies, your digital advertising will be able to draw on a far richer pool of data, including consumer interactions, choices, and transactions.

Development of Comprehensive Channels of Interaction

Advertising platforms like Google Ads and social media are becoming more popular among businesses. Direct mail campaigns are one kind of marketing communication, sales call to prospective clients, and in-person visits from clients. Whatever channel your consumers choose to engage with your company, it’s essential to provide them with a smooth, customized experience.

Omni-channel success begins with a detailed consumer profile fed by a customer data platform. If you do not have the proper marketing software, your clients may have a poor experience with you on several platforms. That is an issue since clients who are unclear on what they want cannot make a purchase.

Adopting a More Personalized Approach to Advertising is The Norm Now

Marketing Messages that are universally sent to all customers, both present and prospective, are no longer appropriate. Consider the impact of brand loyalty on advertising, for instance. One customer’s connection with your business is not the same as another’s, even if they have made many purchases from you.

With marketing technology, particularly a customer data platform, it is now feasible to personalize marketing communications in response to individual customers’ actions. The most excellent way to learn what a consumer wants is to tailor your marketing to their purchases, purchasing habits, and associated activities.

3. Benefits of Customer Data Platform

Track the Most Productive Advertising Avenues

Knowing who you are selling to enables you to focus on the most effective methods of communication. Their use patterns may help you determine the best places to advertise to them, increasing your chances of success.

Make Better Products and Services Available

Understanding your clientele has applications beyond advertising and sales. Customers’ pain concerns are a goldmine of information for developing fresh offerings that appeal to your target market.

Upgrades Your Advertising Language

With a deeper understanding of your target demographic, you can craft more persuasive marketing communications. Knowing your potential market’s language, pain points desired solutions, and previous purchases allow you to communicate with them more effectively.

Accumulate All of Your Client Information in One Centralized Database

There are many different places where data on your customers may be found. A customer data platform consolidates data from several sources into a centralized repository, giving you a complete view of your clientele in one convenient location. There is no need to go between applications to compile data on your clientele.

4. Final Verdict

Consolidating real-time data sources, linking them to a customer profile, and making them instantly deployable in a campaign gives a CDP a great chance of winning over your present marketing team members. As the pace of your campaigns increases on a global scale, you may find yourself in the advantageous situation of improving the degree of customization and targeted advertising. This aligns with a decline in time spent on data cleansing and making ads.

Business

Navigating the Process of Selling Deceased Estate Shares

This article aims to provide a comprehensive guide to selling shares from a deceased estate. Process of Selling Deceased Estate Shares.

Table of Contents

1. Understanding the Basics of Selling Deceased Estate Shares

Dealing with a deceased estate can be a challenging and emotional process, especially when it comes to handling financial assets like shares. This article aims to provide a comprehensive guide to selling shares from a deceased estate.

2. What are Deceased Estate Shares?

Deceased estate shares refer to the stocks and shares that were owned by an individual who has passed away. These shares become part of the deceased’s estate and are subject to the terms of their will or estate plan.

3. The Importance of Valuing the Shares

The first step in selling deceased estate shares is to obtain a current valuation. This valuation is crucial for several reasons: it helps in distributing the estate among beneficiaries, it may be necessary for tax purposes, and it gives an idea of the market value of the shares.

4. Legal Requirements and Executor Responsibilities

The executor of the estate plays a pivotal role in the management and distribution of the deceased’s assets. This section will cover the legal responsibilities and steps the executor needs to take to lawfully sell the shares.

5. Obtaining Probate

Before any action can be taken with the shares, it’s often necessary to obtain probate. Probate is a legal process that confirms the executor’s authority to deal with the deceased’s assets.

Transferring Shares into the Executor’s Name

Once probate is granted, shares may need to be transferred into the name of the executor. This process varies depending on the company and the type of shares.

6. The Process of Selling Shares

After completing legal formalities, the executor can proceed with selling the shares. This section will outline the steps involved in this process, including choosing a brokerage or financial service, understanding market conditions, and making informed decisions.

Deciding on the Right Time to Sell

Timing can significantly impact the returns from selling shares. Executors need to consider market conditions and financial advice to determine the best time to sell.

Completing the Sale

This subsection will detail the actual process of selling shares, including placing orders, handling transaction fees, and ensuring all regulatory requirements are met.

7. Navigating Tax Implications and Reporting

Managing tax obligations is a critical aspect of selling deceased estate shares. This section will explain the potential tax implications and the importance of accurate reporting for both capital gains tax and inheritance tax considerations.

Understanding Capital Gains Tax Responsibilities

When shares are sold, any profit made from the time of the deceased’s passing to the sale date may be subject to capital gains tax. Executors need to be aware of these implications and plan accordingly.

Inheritance Tax Considerations

In some jurisdictions, the value of the deceased estate’s shares might impact inheritance tax calculations. It’s essential for executors to understand these aspects in order to ensure compliance with tax laws.

8. Common Challenges and How to Overcome Them

Selling deceased estate shares can present unique challenges. This section will discuss common issues such as disputed wills, fragmented information about the shares, and market volatility.

Dealing with Disputed Wills and Beneficiary Disagreements

Disputes over the will or disagreements among beneficiaries can complicate the process. Executors must handle these situations delicately and legally.

Managing Market Volatility

Shares can be subject to market fluctuations. Executors should be prepared for this volatility and may need to consult financial advisors to navigate these waters effectively.

9. Tips for Executors Handling Deceased Estate Shares

This section will provide practical advice for executors, including the importance of seeking professional advice, keeping thorough records, and communicating clearly with beneficiaries.

Seeking Professional Financial and Legal Advice

The complexity of selling shares from a deceased estate often necessitates professional advice. This can range from legal counsel to financial advisory services.

Record Keeping and Communication with Beneficiaries

Maintaining transparent and thorough records is crucial. Executors should also prioritize clear and consistent communication with all beneficiaries to avoid misunderstandings.

Conclusion

Selling shares from a deceased estate is a responsibility that requires careful attention to legal, financial, and interpersonal dynamics. By understanding the process, staying informed about tax obligations, and tackling challenges head-on, executors can fulfill their duties effectively and respectfully.

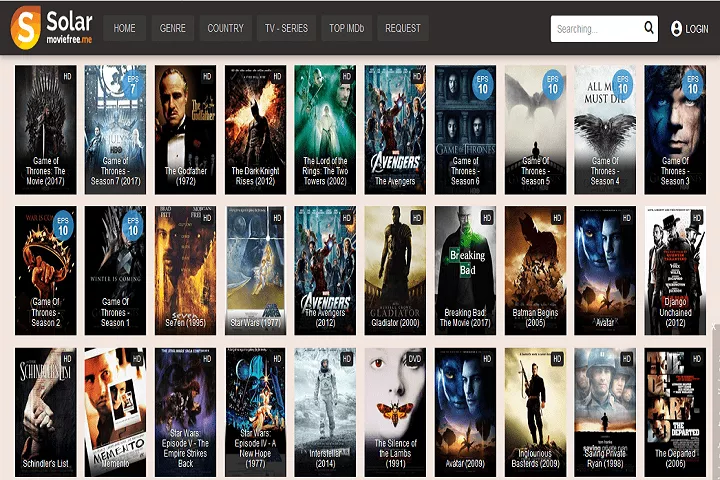

Instagram3 years ago

Instagram3 years agoBuy IG likes and buy organic Instagram followers: where to buy them and how?

Instagram3 years ago

Instagram3 years ago100% Genuine Instagram Followers & Likes with Guaranteed Tool

Business4 years ago

Business4 years ago7 Must Have Digital Marketing Tools For Your Small Businesses

Instagram3 years ago

Instagram3 years agoInstagram Followers And Likes – Online Social Media Platform