Business

Internal Communication – Doing Research and Creating a Clear Objective And Plan

Internal Communication Doing Research and Creating a Clear Objective, Creating a healthy organization is essential to start and run a business successfully.

Creating a healthy organization is essential to start and run a business successfully. You have to unify and engage your workforce in a joint mission. This is much more possible to achieve when you have a reliable two-way internal communications plan and feature-rich internal communication software. To make sure that your internal communication is efficient and focused, you have to perfect your domestic communication plan. You have to utilize all available avenues of communication. This can offer many benefits for your employees and your organization as a whole.

Serious employees are always passionate and proactive. If you recognize and appreciate their work, they love to contribute to their jobs if they know how their work fits in the mission of the company. Let them understand the purpose of their work. Doing so will help them in understanding that their contribution is valued. When your organization is facing some challenges or problems, make your employees a part of the actual dialogue on the challenge. This can inspire your employees for higher engagement.

This, as a result, can make your employees happier and involve them reduce employee attrition, and therefore also save money on training new employees. Happy employees are always more productive. Good internal communications have also been shown to boost the bottom line for businesses. It is not a difficult task to accomplish. All you need is an excellent domestic communication plan partnered with useful internal intranet software.

1. Research Your Plan

First of all, you need to know where you want to go and then devise a plan. There has to be an action plan. You need to understand where your organization is now and where you want to go.

It takes energy and commitment to adopt and implement a new internal communication plan. It would help if you involved all the key stakeholders in the planning process. Your employees are the key stakeholders. Learn how your employees want to communicate internally. After all, they are going to share most of the information.

It is essential to survey their thoughts. This will produce yourself with a larger picture. You should also consider focus groups and dig deeper into the challenges you’re facing at present. If you are using some internal communication tools, analyze them. To make improvements, you need to find problems. See if you need to invest in internal communication software. This will help you in having a system in place.

2. Create Clear Objectives and Plan

Once you have completed your research, it’s time to set clear objectives and create a clear plan to achieve those objectives. Your research leaves you with raw data. You need to analyze and use this information to identify and set internal communication aims and create a plan to achieve these aims. In addition to the usual planning for setting actionable objectives, responsibilities, deadlines, and timelines, it takes a team to create a plan. All team members have to agree on clear outcomes.

You need to define your internal communication plan in measurable objectives.

- What do you want to achieve with this plan?

- When will you be able to measure your goals?

- How will these measurable objectives help?

It would help if you had a SMART plan

S – Specific

M – Measured

A – Attainable

R – Realistic

T – Timely

Though it is essential to have a smart strategy, however, this is not the only thing you need. You need to choose the right one from available internal communication platforms. Choosing internal communication software should also be a part of the planning. Your communication much depends on your internal communication software.

Business

Key Strategies for Successful Digital Transformation

True digital transformation starts with culture. Creating a digital culture means more than just incorporating digital tools into your daily operations.

Shifting towards more digital practices is not just about adopting new technologies but involves a holistic change in culture, processes, and operations. Ensuring a successful digital transformation involves strategic planning, a clear vision, and a touch of creativity. Here’s how you can navigate this exciting yet challenging journey:

Table of Contents

1. Understanding the Digital Imperative

The first step towards a successful digital transformation is understanding the urgency and need for change. It’s not merely about keeping up with trends but recognizing the digital imperative to stay competitive and relevant. Analyzing market trends, customer behavior, and technological advancements can offer valuable insights into what drives digital success.

2. Creating a Digital Culture

True digital transformation starts with culture. Creating a digital culture means more than just incorporating digital tools into your daily operations. It requires fostering an environment of continuous learning, innovation, and openness to change. Encouraging collaboration, agility, and a fail-fast mindset can empower teams to experiment and innovate.

3. Investing in People and Skills

People are the most critical asset in the digital transformation journey. Investing in training and development ensures that your team not only has the necessary digital skills but also understands the importance of their role in the transformation process. Promoting a culture of learning and growth can significantly enhance employee engagement and productivity.

In a rapidly evolving digital landscape, the complexity of managing an organization’s IT infrastructure has significantly increased. Leveraging managed IT services can be a strategic move to ensure seamless technology integration and operation. This approach allows businesses to focus on their core objectives, knowing that the IT aspects are professionally managed.

4. Developing a Strategic Roadmap

Having a clear, strategic roadmap is crucial. This roadmap should outline key goals, timelines, technology investments, and how digital transformation aligns with the organization’s overall objectives. Remember, this is a marathon, not a sprint. Setting realistic milestones and adjusting the plan as necessary can help maintain direction and focus.

5. Putting the Customer at the Core

At the heart of digital transformation is the customer. Understanding and responding to changing customer needs is paramount. This means leveraging data analytics to gain insights into customer behavior and preferences. Tailoring experiences to meet these needs can significantly improve customer satisfaction and loyalty.

6. Ensuring Seamless Technology Integration

One of the pillars of digital transformation is the seamless integration of new technologies into current business processes. This integration should not disrupt existing operations but rather enhance efficiency and productivity. Choosing the right technology partners and platforms that align with your business objectives is crucial for a smooth transition.

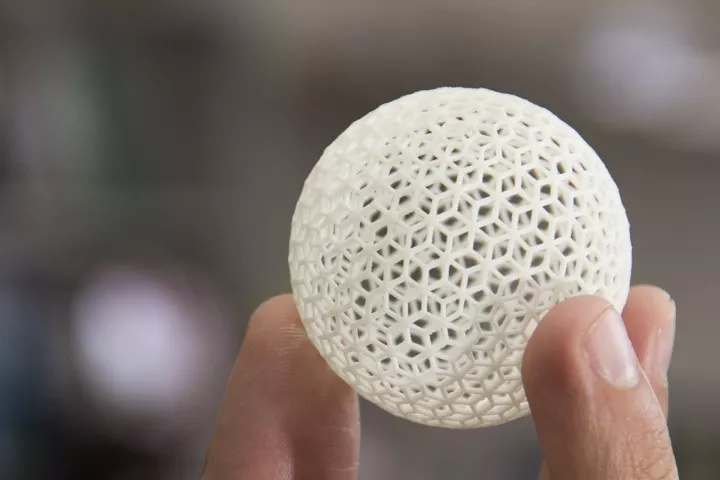

7. Fostering an Ecosystem of Innovation

To stay ahead in the digital curve, organizations must foster an ecosystem that encourages innovation. This entails not only adopting new technologies but also creating an environment where creativity is nurtured and valued. Establishing partnerships with startups, investing in R&D, and participating in industry think tanks can stimulate fresh ideas and innovative thinking.

8. Embracing Agile Methodologies

Agility is key to adapting to the fast-paced digital world. Embracing agile methodologies can accelerate innovation and improve product delivery. This flexible, iterative approach encourages collaboration, customer feedback, and continuous improvement, making it easier to pivot and adapt to changing market demands.

9. Monitoring, Measuring, and Adapting

Finally, it’s essential to have mechanisms in place for monitoring and measuring the success of your digital transformation efforts. Regularly analyzing performance against set goals and KPIs can reveal areas of improvement and opportunities for further innovation. Being ready to adapt your strategy based on these insights is key to continuous growth and success in the digital age.

10. Leveraging Data and Analytics

Data is a powerful asset in digital transformation. Leveraging data analytics can provide actionable insights, drive decision-making, and enhance strategic planning. However, it’s critical to ensure data quality and security to build trust and deliver value.

Digital transformation is an ongoing journey rather than a destination. It requires a strategic approach, a willingness to embrace change, and a commitment to innovation. By understanding the digital imperative, creating a culture of digital readiness, and investing in the right strategies, organizations can navigate the complexities of digital transformation successfully. Remember, the goal is not just to survive in the digital age but to thrive and unlock new opportunities for growth and innovation.

Instagram3 years ago

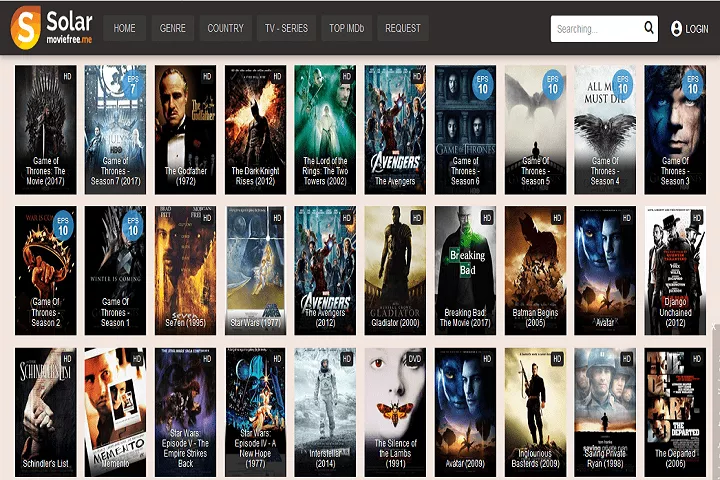

Instagram3 years agoBuy IG likes and buy organic Instagram followers: where to buy them and how?

Instagram3 years ago

Instagram3 years ago100% Genuine Instagram Followers & Likes with Guaranteed Tool

Business4 years ago

Business4 years ago7 Must Have Digital Marketing Tools For Your Small Businesses

Instagram3 years ago

Instagram3 years agoInstagram Followers And Likes – Online Social Media Platform